- Whats new version 1.1?

What's new in DT FormMax?

In this version...

1. Forms for tax year 2009

- T4A and RL-1/RL-2 - Data entry

- T4A slip - Statement of pension, retirement, annuity, and other income

- RL-1(T4A) - Employment and other income

- RL-2 - Retirement and annuity income

- T4A - Pension and other income summary (in-house form)

- T4A summary - Summary of pension, retirement, annuity, and other income

- T4A - Statement of pension, annuity, and other income (government copy)

- RL-1(T4A) summary - Summary of source deductions and employer contributions

- RL-1(T4A) - Employment and other income (government copy)

- RL-2 summary - Retirement and annuity income

- RL-2 - Retirement and annuity income (government copy)

- T4A slip - Statement of pension, retirement, annuity, and other income

- RL-1(T4A) - Employment and other income

- RL-2 - Retirement and annuity income

- T4A - Pension and other income summary (in-house form)

- T4A summary - Summary of pension, retirement, annuity, and other income

- T4A - Statement of pension, annuity, and other income (government copy)

- RL-1(T4A) summary - Summary of source deductions and employer contributions

- RL-1(T4A) - Employment and other income (government copy)

- RL-2 summary - Retirement and annuity income

- RL-2 - Retirement and annuity income (government copy)

- RL-4 - Rent increase - letter

- RL-4 - No rent increase - letter

- RL-4 - 1st notice of non payment

- RL-4 - 2nd notice of non payment

- RL-4 - 3rd notice of non payment

- RL-4 - 4th notice of non payment

- RL-4 - No rent increase - letter

- RL-4 - 1st notice of non payment

- RL-4 - 2nd notice of non payment

- RL-4 - 3rd notice of non payment

- RL-4 - 4th notice of non payment

T2000 to T3000 forms

- T2062 - Request by a non-resident

of Canada for a certificate of compliance related to the

disposition of taxable Canadian property

- TP-1097 - Notice of disposition or

proposed disposition of taxable Quebec property by an individual or

corporation not resident in Canada

2. Forms for tax year 2010

Please note that all 2009 forms are

available for 2010.

3. Under the File menu

Open an existing file ->

this option is now called Open file.

Save all -> which now saves all documents open in the application.

Incremental save -> which allows the user to save the current document with the same name with the suffix "^1".DTF09

Recent files -> which allows the user to keep track of your recent files, up to a maximum of 15 entry files.

Save all -> which now saves all documents open in the application.

Incremental save -> which allows the user to save the current document with the same name with the suffix "^1".DTF09

Recent files -> which allows the user to keep track of your recent files, up to a maximum of 15 entry files.

4. Under the View menu

Restore docking windows original

position -> which will dock all the windows in the original

position as per the application, not as per the user's

settings.

Hide docking windows -> which hides all docking windows to have a wider work environment on the screen.

Hide docking windows -> which hides all docking windows to have a wider work environment on the screen.

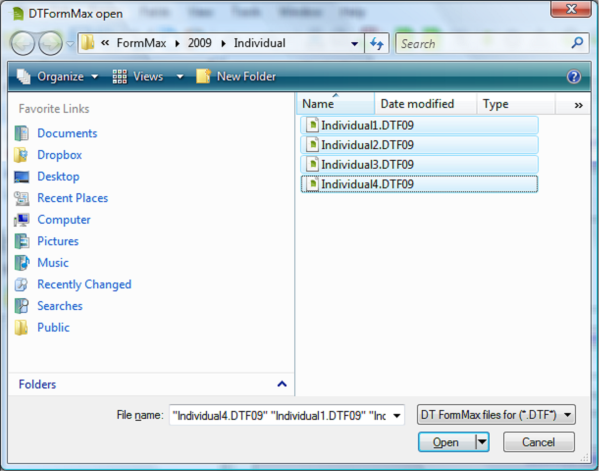

5. When opening a file

When the user chooses to open a

document form, he or she can now choose one or as many files as

required:

6. Modifications in different dialogs

Under

the Tools menu :

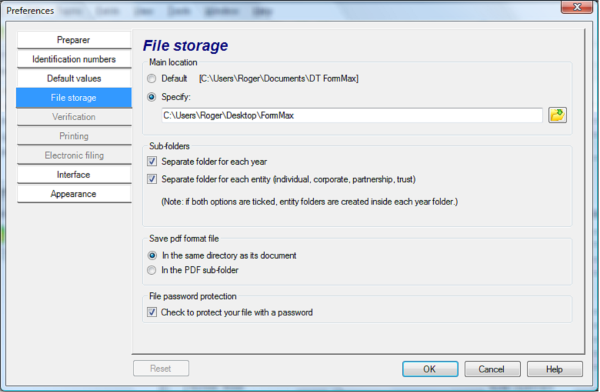

i) Preferences

-> File storage

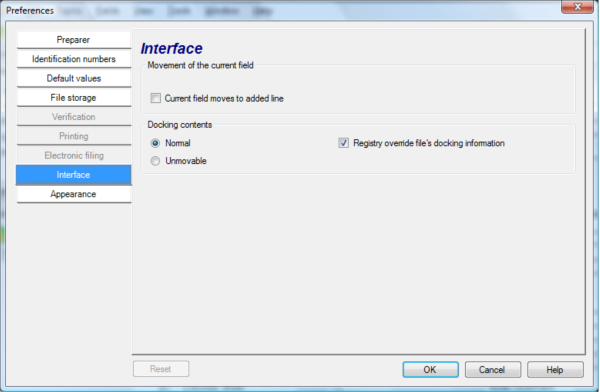

ii) Preferences -> Interface

In the File storage section of the Preferences dialog box, there are 2 new settings for the user.

The first one is the choice for the default location to save the

PDF files. Two options are available:

1) In the same directory as its document

2) In the PDF subfolder

The second one is File password protection, for which there is no password by default. If the user selects it, then he/she will need to enter a password each time in order to save the file.

If the file contains a password, the user will be prompted to enter the password to open the file.

A new setting is now available to the user regarding the Docking contents section: Registry override file's docking information.

If this option is ticked, this means that if there is some docking information recorded into the current document, they won't overrun the registry information. If unticked, it means that the document docking information will be overriding the registry docking information.

7. Bug issue resolved in this version

In the previous version of DT

FormMax, a bug affected the field behavior regarding data entry,

which caused the system to unintentionally remove the first

character of the next field when a numeric value was entered. This

bug has been fixed in the new version of the program.

January 27, 2010