- What's new in DT FormMax version 5.3?

In this version...

1. Version highlights

New tax rate on dividends other than eligible dividends for tax year 2014

The federal gross-up factor on dividends other than eligible dividends has been decreased from 25% to 18% of the dividends received for tax year 2014, as announced by Finance Canada. As a result, the related federal tax credit rate will be reduced from 13.333% to 11.017%.

The federal gross-up factor on dividends other than eligible dividends has been decreased from 25% to 18% of the dividends received for tax year 2014, as announced by Finance Canada. As a result, the related federal tax credit rate will be reduced from 13.333% to 11.017%. The Quebec government has also announced the harmonization of its gross-up factor with that of the federal. However, the Quebec tax credit rate for dividends other than eligible dividends is reduced from 8% to 7.05%.

2. Enhancements

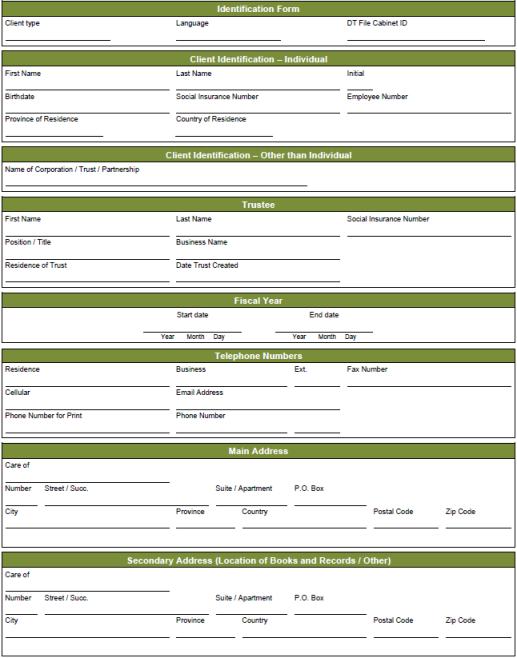

a. Identification form

In order to simplify the use of DT FormMax, we have developed a

unique identification form. From now on, whether you are an

individual, a corporation, a partnership or a trust, you will only

have one identification form to complete. This identification form

will contain all the information required to complete the other

forms.

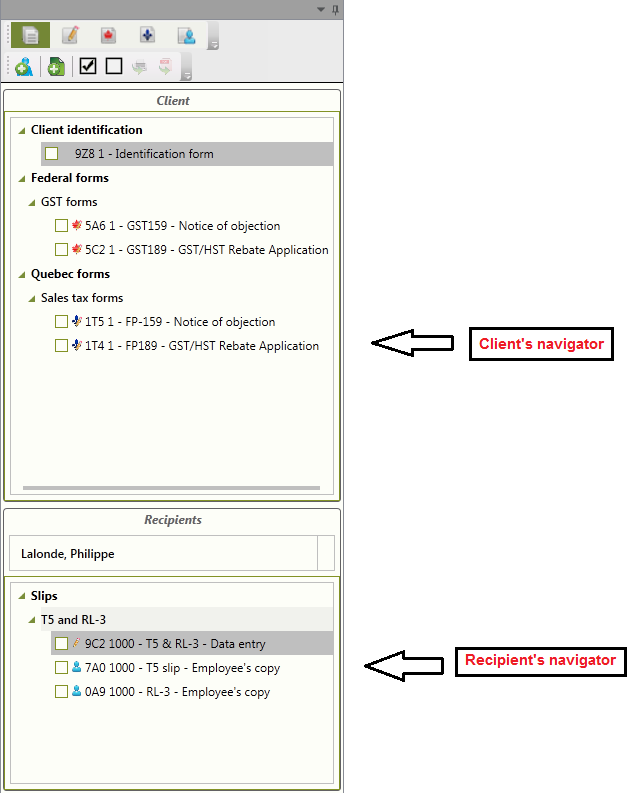

b. Navigator

To improve the use of DT FormMax, the Navigator has been split

in two sections. Henceforth, you will have a "Client" navigator

that will display only your client's forms, and a "Recipients"

navigator that will display only your recipients' forms

(T-slips/RL-slips). This change will allow you to better manage

your recipients, to browse between recipients more efficiently and

to access a complete listing of the recipients. In addition, the

"Recipients" navigator comes equipped with a search bar that will

facilitate the search for your recipients.

3. Modified forms

| Forms for tax year 2013 | |

| Federal forms | |

| RC1 | New form version from the CRA. |

| RC1A | New form version from the CRA. |

| RC1B | New form version from the CRA. |

| RC1C | New form version from the CRA. |

| Forms for tax year 2014 | |

| Federal forms | |

| CPT16 | New form version from the CRA. |

| GST44 | New form version from the CRA. |

| T1-OVP | New form version from the CRA. |

| T1261 | New form version from the CRA. |

| Quebec forms | |

| MR-69 | New form version from Revenu Québec. |

| TP-1029.CS.3 | New form version from Revenu Québec. |

4. New forms

| Slips and summaries | |

| Federal | |

| T215 | Past Service Pension Adjustment (PSPA) Exempt from Certification. |

| T215 Summary | Summary of Past Service Pension Adjustments (PSPAs) Exempt from Certification. |

| Federal forms | |

| GST10 | Application or Revocation of the Authorization to File Separate GST/HST Returns and Rebate Applications for Branches or Divisions. |

| GST17 | Election Concerning the Provision of a Residence or Lodging at a Remote Work Site. |

| GST22 | Real Property – Election to Make Certain Sales Taxable. |

| GST27 | Election or Revocation of an Election to Deem Certain Supplies to be Financial Services for GST/HST Purposes. |

| GST159 | Notice of Objection (GSH/HST) |

| GST189 | General Application for Rebate of GST/HST |

| Quebec forms | |

| FP-159 | Notice of Objection (GST/HST) |

| FP-189 | General GST/HST Rebate Application |

| VD-403 | General Application for a Québec Sales Tax (QST) Rebate |

5. Carryforward of client data

When you carry forward the file of a client, the information entered in the Client identification form, as well as the personal information of each recipient will be carried forward automatically to the following year. Considering the enhancements brought to the navigator and the client identification form, we recommend that you carry forward your 2013 data to 2014 using this new version (5.3) or a subsequent version.

If you have already performed the carryforward of your clients' files from 2013 to 2014 with version 5.1, we ask that you do it once again using version 5.3 to ensure that your data are properly carried forward.