Tax Information Phone Service

(TIPS)

Tax Information Phone Service

(TIPS)

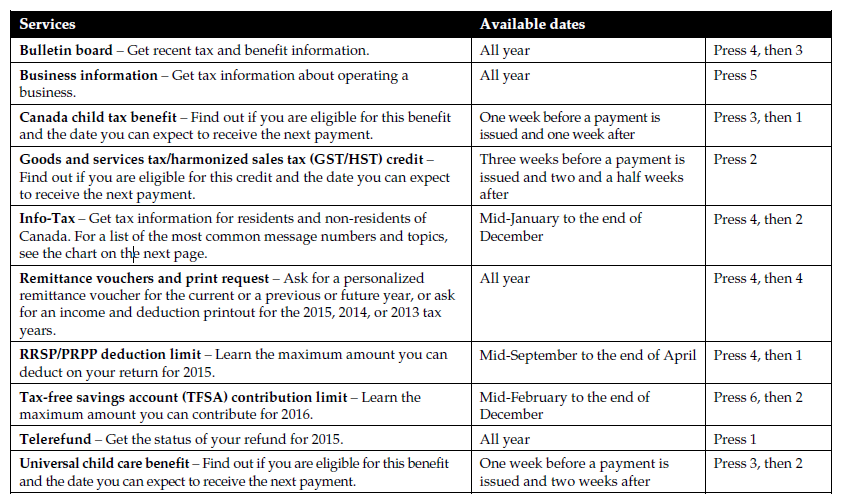

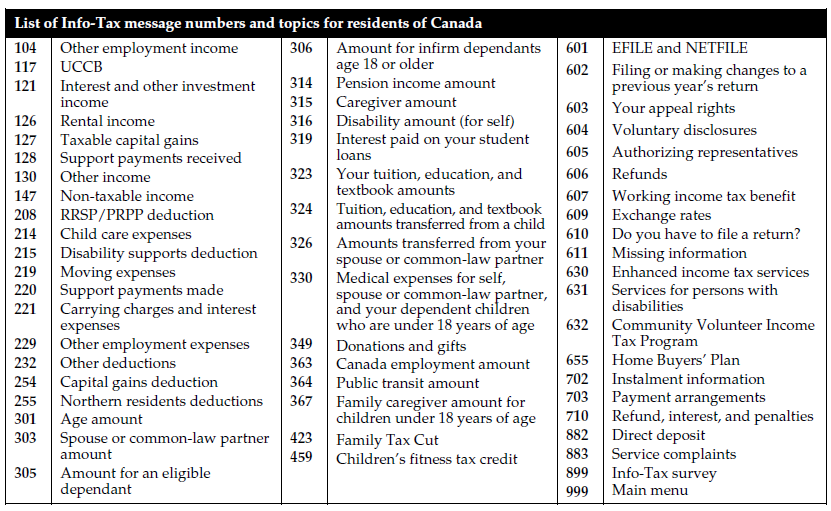

For personal and general tax information by telephone, use our automated service, TIPS, by calling 1-800-267-6999.

To get information from Telerefund, GST/HST credit, CCTB, UCCB, TFSA, or RRSP/PRPP deduction limit, you will have to give us your social insurance number, your month and year of birth, and the total income you entered on line 150 of your return.

To get information from Remittance vouchers and print request, you will have to give us your social insurance number, your day, month, and year of birth, and the total income you entered on line 150 of your return. In addition, if your identification has been validated, we will ask you to confirm the postal code we currently have on file.

If you call before May 1, you will need the total income amount you entered on line 150 of your 2014 return. If you call on or after May 1, you will need the total income amount you entered on line 150 of your 2015 return.

Get ready to file your 2015 income tax and benefit return

Go to cra.gc.ca/getready

Take advantage of the quick, easy, and secure electronic services that the Canada Revenue Agency offers.

| Electronic services | cra.gc.ca/electronicservices |

|---|---|

| NETFILE | cra.gc.ca/netfile |

| My Account | cra.gc.ca/myaccount |

| Direct deposit | cra.gc.ca/directdeposit |

| Electronic payments | cra.gc.ca/payments |

| Represent a Client | cra.gc.ca/representatives |

| EFILE | cra.gc.ca/efile-individuals |

| My Business Account | cra.gc.ca/mybusinessaccount |

| My Payment | cra.gc.ca/mypayment |

| MyCRA mobile app | cra.gc.ca/mobileapps |

|

|

|