Schedule 8, Capital Cost Allowance (CCA)

Schedule 8, Capital Cost Allowance (CCA)

Schedule 8, Capital Cost Allowance (CCA)

Paragraph 20(1)(a) allows a corporation to deduct part of the capital cost of certain depreciable property from income it earned in the year from a business or property. This deduction is called capital cost allowance.

Complete Schedule 8 to calculate CCA.

When a tax year is shorter than 12 months, you generally have to prorate the CCA.

Under Part XI of the Income Tax Regulations, depreciable property is grouped into prescribed classes. Schedule II of the Regulations contains a complete list of these prescribed classes.

A maximum rate is prescribed for each class. Apply the prescribed rate to the undepreciated capital cost of the class at year-end to determine the maximum CCA you can claim. You can deduct any amount up to the maximum that is available for the year.

Disability-related modifications

You can deduct outlays and expenses you incur for eligible disability-related modifications made to a building in the year you paid them, instead of having to add them to the capital cost of your building. Eligible disability-related modifications include changes you make to accommodate wheelchairs. You can also deduct expenses paid to install or get disability-related devices and equipment.

You can claim this as "Other deductions" on Schedule 1, Net Income (Loss) for Income Tax Purposes.

Available-for-use rule

The available-for-use rule determines the earliest tax year in which you can claim CCA for depreciable property.

When is property available for use?

Property other than a building is considered available for use at the earliest of several dates. The following are some examples of these dates:

-

when the corporation first uses the property to earn income

-

the beginning of the first tax year that starts at least 358 days after the tax year during which the corporation acquired the property

-

immediately before the corporation disposes of the property

-

when the corporation can use the property to either produce a saleable product or perform a saleable service

A building is considered available for use on the earliest of the following dates:

-

when the corporation uses all or substantially all of the building for its intended purpose

-

when construction of the building is completed

-

the beginning of the first tax year that starts at least 358 days after the tax year during which the corporation acquired the property

-

immediately before the corporation disposes of the property

-

when the corporation acquires a replacement property, if it is replacing one it involuntarily disposed of (for example, expropriation) that it either acquired before 1990 or had already become available for use

Note

If a corporation acquires a property for a long-term project, it can elect to limit the impact of the available-for-use rule. This election is not available for rental buildings. To make this election, send the CRA a completed Form T1031, Subsection 13(29) Election in Respect of Certain Depreciable Properties, Acquired for use in a Long Term Project, with your return.

References

Subsections 13(26) to 13(32)

Election under Regulation 1101(5q)

Line 101 - Is the corporation electing under Regulation 1101(5q)?

Tick the yes or no box.

This election allows you to include certain property usually included in classes 8 and 43 in a separate class. You have to have acquired each property at a capital cost of at least $1,000. The types of properties that qualify for this election include manufacturing and processing property, photocopiers, and electronic communications equipment, such as facsimile transmission devices or telephone equipment.

You can elect to classify a property in a separate class or several properties in one or more than one separate class.

This election can allow you to claim a terminal loss, which is any remaining undepreciated capital cost at the time of disposition of the properties in this class. For more information on terminal losses, see "Column 10 - UCC" (undepreciated capital cost).

CCA rates and classes

Purpose-built rental housing - Class 1

Under proposed changes, an accelerated CCA rate of 10% under class 1 would be available for new eligible purposebuilt rental housing projects that:

-

begin construction after April 15, 2024, and before 2031, and

-

are available for use before 2036

Investments eligible for this measure would continue to benefit from the accelerated investment incentive (AII). The AII currently suspends the half-year rule, providing a CCA deduction at the full rate for eligible property that becomes available for use before 2028.

Eligible property would be new purpose-built rental housing that is a residential complex:

-

with at least 4 private apartment units (a unit with a private kitchen, bathroom, and living areas) or 10 private rooms or suites, and

-

in which at least 90% of residential units are held for long-term rental

If the above conditions are met, the new rate would also be available to:

-

projects that convert existing non-residential real estate, such as an office building, into a residential complex

-

new additions to an existing residential complex

The accelerated CCA would not apply to renovations of existing residential complexes.

Productivity-enhancing assets - Classes 44, 46, and 50

Under proposed changes, for new additions of property to CCA classes 44, 46, and 50, immediate expensing (a 100% first-year deduction) would be provided if the property is acquired after April 15, 2024, and becomes available for use before 2027. Property that becomes available for use in 2027 would continue to benefit from the AII.

Zero-emission vehicles - Classes 54 and 55

Two CCA classes (54 and 55) were added for zero-emission vehicles (ZEVs) acquired after March 18, 2019.

Class 55 was created for zero-emission vehicles otherwise included in class 16, essentially automobiles for lease or rent and taxicabs, with the same CCA rate of 40%. Class 54 was created for zero-emission vehicles that would otherwise be included in class 10 or 10.1, essentially other automobiles, with the same CCA rate of 30%. The CCA still applies on a declining-balance basis.

A corporation may elect to not include in class 54 or 55 a vehicle that would otherwise be a zero-emission vehicle. When such an election is filed, the vehicle will no longer be considered to be a zero-emission vehicle. As a result, the vehicle will be included in its usual CCA class 10, 10.1 or 16. A corporation has to file this election with the minister of National Revenue in its return of income for the tax year in which the vehicle is acquired.

An eligible zero-emission vehicle is essentially a motor vehicle for use on streets and highways (excluding a trolley bus or vehicle operated only on rails). It must be fully electric, or a plug-in hybrid that has a battery capacity of at least 7 kWh, or fully powered by hydrogen. It must not have been used, or acquired for use, for any purpose before it was acquired by the corporation, unless the corporation acquires it after March 1, 2020.

It cannot be a vehicle:

-

for which the Government of Canada paid assistance under a prescribed program such as the federal purchase incentive announced in the 2019 federal budget (presently there is only one prescribed program)

-

that the corporation elected not to include in class 54 or 55

-

for which an amount has been deducted as CCA or a terminal loss has been claimed by another person or partnership

In addition, a zero-emission vehicle has to be acquired, and become available for use, after March 18, 2019, and before 2028. An enhanced first-year CCA is available as follows:

-

100% after March 18, 2019, and before 2024

-

75% after 2023 and before 2026

-

55% after 2025 and before 2028

Under proposed changes, the immediate expensing measure for certain CCA classes would be reinstated for qualifying property acquired on or after January 1, 2025, and that becomes available for use before 2030, with a four-year phase out after 2029.

For the enhanced first-year allowance, the following step should be done before calculating the CCA:

-

increase the net capital cost addition to the new class for property that becomes available for use before 2028 as follows:

-

For class 54, increase the capital cost addition by an amount equal to:

-

2 1/3 times the net addition to the class for property that becomes available for use before 2024

-

1 ½ times the net addition to the class for property that becomes available for use in 2024 or 2025

-

5/6 times the net addition to the class for property that becomes available for use after 2025 and before 2028

-

-

For class 55, increase the capital cost addition by an amount equal to:

-

1 ½ times the net addition to the class for property that becomes available for use before 2024

-

7/8 times the net addition to the class for property that becomes available for use in 2024 or 2025

-

3/8 times the net addition to the class for property that becomes available for use after 2025 and before 2028

-

-

-

suspend the existing CCA half-year rule

Multiply the result by the prescribed CCA rate of 30% for class 54 and 40% for class 55.

The CCA will apply to any remaining balance for the new classes using the set rate for each class.

These measures do not change the total amount that can be deducted over the life of the vehicle, it just allows a larger deduction in the first year.

A zero-emission passenger vehicle is an automobile that is included in class 54. When the capital cost of a zero-emission passenger vehicle is more than a prescribed amount ($61,000 plus sales tax for vehicles acquired on or after January 1, 2023), the capital cost of the vehicle is deemed to be the prescribed amount. This amount will be reviewed annually.

If a zero-emission passenger vehicle is disposed of to a person or partnership with which the corporation deals at arm's length and its cost is more than the prescribed amount, the proceeds of disposition will be adjusted based on a factor equal to the prescribed amount as a proportion of the actual cost of the vehicle. But for dispositions made after July 29, 2019, the actual cost of the vehicle will be adjusted for payment or repayment of government assistance.

Zero-emission vehicles - Class 56

A temporary enhanced first-year capital cost allowance (CCA) of 100% is available for eligible zero-emission automotive equipment and vehicles (other than motor vehicles) that currently do not benefit from the accelerated rate provided by classes 54 and 55. These vehicles and equipment are included in class 56. They have to be acquired after March 1, 2020, and become available for use before 2028.

The enhanced CCA applies only for the tax year in which the equipment or vehicle first becomes available for use. It is subject to the following phase-out:

-

100% after March 1, 2020, and before 2024

-

75% after 2023 and before 2026

-

55% after 2025 and before 2028

Under proposed changes, the immediate expensing measure for certain CCA classes would be reinstated for qualifying property acquired on or after January 1, 2025, and that becomes available for use before 2030, with a four-year phase out after 2029.

To be eligible for the enhanced first year allowance, a vehicle or equipment must be automotive (that is, self-propelled) and fully electric or powered by hydrogen. Vehicles or equipment that are powered partially by electricity or hydrogen (which includes hybrid vehicles and vehicles that require human or animal power for propulsion) are not eligible.

Class 56 captures automotive equipment that is not designed for use on highways or streets such as zero-emission aircraft, watercraft, trolley buses and railway locomotives. Additions or alterations may qualify if they convert automotive equipment (other than a motor vehicle) into a zero-emission property.

The CCA is deductible on any remaining balance on a declining balance basis at a rate of 30%.

An election is available to not include the vehicle or equipment in class 56. As a result, the property will then be included in the class for which it would otherwise be eligible.

Class 56 excludes property for which CCA or a terminal loss has previously been claimed by another person or partnership where the equipment was acquired by the corporation on a tax-deferred "rollover" basis or it was previously owned or acquired by the corporation or a non-arm's length person or partnership.

Accelerated investment incentive property

Accelerated investment incentive property (AIIP) is a property (other than property included in classes 54 to 56) that is acquired by the corporation after November 20, 2018, and becomes available for use before 2028.

Under proposed changes, the accelerated investment incentive measure would be reinstated for qualifying property acquired on or after January 1, 2025, and that becomes available for use before 2030, with a four-year phase out after 2029.

The property has to meet one of the following conditions:

-

no person or partnership (including the corporation) has claimed capital cost allowance (or a terminal loss) for the property

-

it has not been transferred to the corporation on a tax-deferred "rollover" basis

-

it was not previously owned or acquired by the corporation or a non-arm's length person or partnership

The following measures are available to AIIP:

-

Accelerated investment incentive - Providing an enhanced first-year allowance for certain eligible property that is subject to the CCA rules. In general, the incentive is made up of two elements:

-

an increase up to 50% of the net capital cost addition to a class for property that becomes available for use before 2024

-

suspending the existing CCA half-year rule (and equivalent rules for Canadian vessels and class 13 property) for property that becomes available for use before 2028.

Note

Under the half-year rule, in general, property other than AIIP or property included in classes 54 to 56, acquired during the tax year, is eligible for only 50% of the normal maximum CCA for the year. You can claim full CCA for that property in the next tax year. See Regulation 1100(2).

-

-

Full expensing for manufacturers and processors - Allowing businesses to immediately write off the full cost of machinery and equipment used for the manufacturing or processing of goods (class 53 or property included in class 43 and acquired after 2025, if the property would have been included in class 53 if it had been acquired in 2025).

-

Full expensing for clean energy investments - Allowing businesses to immediately write off the full cost of specified clean energy equipment (classes 43.1 and 43.2).

A phase-out will begin for property that becomes available for use after 2023. For the 2024 and 2025 years, corporations may immediately write off 75% of specified clean energy equipment (classes 43.1 and 43.2).

Under proposed changes, the immediate expensing measure for certain CCA classes would be reinstated for qualifying property acquired on or after January 1, 2025, and that becomes available for use before 2030, with a four-year phase out after 2029.

An enhanced deduction also generally applies to eligible Canadian development expenses and Canadian oil and gas property expenses incurred after November 20, 2018, and before 2028. The enhanced deduction will begin to be phased out for expenses made after 2023.

The accelerated investment incentive applies to property for which CCA is calculated on a declining-balance basis (including class 14.1, intangible property), as well as property with straight-line depreciation (for example, leasehold improvement, patents, and limited period licences). A phase-out will begin for property that becomes available for use after 2023.

In certain situations, rules related to limited partners, specified leasing properties, specified energy properties and rental properties can restrict a CCA deduction, or a loss for such a deduction, that would otherwise be available. These rules continue to apply.

The accelerated investment incentive does not change the total amount that can be deducted over the life of the property, it just allows a larger deduction in the first year.

For more information, go to canada.ca/taxes-accelerated-investment-income.

Reference

Regulation 1104(4)

S3-F8-C2, Tax Incentives for Clean Energy Equipment

Designated immediate expensing property

Designated immediate expensing property (DIEP) is a property (other than property included in classes 1 to 6, 14.1, 17, 47, 49 and 51) that is acquired by a CCPC after April 18, 2021, becomes available for use in the tax year and before 2024, is designated as such in prescribed form filed by the CCPC within 12 months of the filing-due date for the tax year the designation relates to.

The property has to meet one of the two following conditions:

-

it has never been used and no person or partnership has claimed capital cost allowance (or a terminal loss) for the property

-

it has not been transferred to the corporation on a tax deferred "rollover" basis and it was not previously owned or acquired by the corporation or a non-arm's length person or partnership

Schedule 8, Capital Cost Allowance (CCA), is the prescribed form for the immediate expensing claim.

The immediate expensing incentive has the following characteristics:

-

i t allows CCPCs to immediately write off the full cost of the DIEP up to $1.5 million per tax year

-

i t applies only to the DIEP

-

i t is available only for the year in which the property becomes available for use

-

i t is limited to $1.5 million per tax year, which will be shared among associated members of a group and prorated for tax years shorter than 365 days. If the capital cost of the DIEP is more than $1.5 million and is included in more than one CCA class, the CCPC can decide to which CCA class the immediate expensing incentive is attributed

Note

The immediate expensing deduction does not need to be prorated for a short tax year, as the immediate expensing deduction is already limited to the corporation's prorated immediate expensing limit for the tax year. This applies to tax years ending after April 18, 2021.

The carryforward of excess capacity for CCPCs with less than $1.5 million of eligible capital costs is not allowed. Existing enhanced CCA deductions will not reduce the amount available under this measure.

For details, see examples 6 and 7 under the heading "Schedule 8 examples" that follows.

Completing Schedule 8

This section explains how to complete each column of Schedule 8. Use a separate line for each class of property.

Reference

S3-F4-C1, General Discussion of Capital Cost Allowance

Complete Part 1 if you are associated (under subsection 1104(3.6) of the Regulations) in the tax year with one or more eligible persons or partnerships (EPOPs) with which you have entered into an agreement. The purpose of the agreement is to assign a percentage to one or more of the EPOPs in the tax year to share the immediate expensing limit.

EPOP refers to a corporation that was a CCPC throughout the year, an individual (other than a trust) resident in Canada throughout the year or a Canadian partnership all of the members of which were individuals (other than trusts) or CCPCs throughout the period.

In the table, give the names of the associated EPOPs, their identification number and the percentage assigned under the agreement. Also provide the immediate expensing limit allocated to you. Such amount should be based on the percentage assigned to your corporation in column 3. If the sum of the percentages assigned under the agreement is more than 100%, the immediate expensing limit of the associated group is nil.

Reference

Regulations 1104(3.1) to (3.6)

Complete Part 2 to calculate your CCA deduction.

Column 1 - Class number

Identify each class of property with the assigned class number.

Generally, you have to group all depreciable property of the same class together. Then, calculate CCA on the undepreciated capital cost of all the property in that class.

However, sometimes you have to maintain property of the same class in separate lines. For example, list on separate lines property that you would usually group in the same class but use to earn income from different sources. Also, list on a separate line each class 10.1 passenger vehicle and property you elected to identify in a separate class under Regulation 1101(5q).

Note

If a class number has not been provided in Schedule II

of the Income Tax Regulations for a particular class

of property, use the subsection provided in

Regulation 1101 or 1100.

Reference

Regulations 1100 and 1101

Column 2 - Undepreciated capital cost (UCC) at the beginning of the year

Enter the amount of the undepreciated capital cost at the end of the previous tax year.

Column 3 - Cost of acquisitions during the year

For each class, enter the total cost of depreciable property you acquired in the tax year. Depreciable property is considered acquired when it becomes available for use. See page 46 for more information on the available-for-use rule.

Reduce the capital cost of a property by the following amounts:

-

goods and services tax/harmonized sales tax (GST/HST) input tax credit claimed or entitled to be claimed, or rebate received or entitled to be received in the year

-

federal investment tax credits (ITCs), other than scientific research and experimental development ITCs, used to reduce taxes payable or claimed as a refund in the previous tax year

-

reduction of capital cost after the application of section 80

-

provincial or territorial ITCs received or entitled to be received in the current year

-

government assistance received or entitled to be received in the year and described under paragraph 13(7.1)(f)

-

deemed decrease, under subsection 13(40), to the undepreciated capital cost of class 14.1 where you acquired property of that class through a non-arm's length transfer and the property had been eligible capital property of the transferor before January 1, 2017

Add to the capital cost of the property:

-

deemed increase, under subsection 13(39), to the undepreciated capital cost of class 14.1 where you disposed of property of that class after December 31, 2016, and that property had been eligible capital property before January 1, 2017

-

repayment of GST/HST input tax credit previously claimed

-

government assistance repaid in the year that previously reduced the capital cost and described under paragraph 13(7.1)(d)

The cost of acquisitions generally means the full cost of acquiring the property, including legal, accounting, engineering, and other fees. Land is not a depreciable property, and is therefore not eligible for CCA. List any acquisitions that are not subject to the 50% rule, separately. See Regulations 1100(2) and (2.2) for more information about these types of acquisitions. Do not enter section 85 transfers in this column.

Note

A corporation that receives an amount of

non-government assistance to buy depreciable property

has the option of either reducing the capital cost of the

property by this amount, or including the assistance in

its income.

References

Subsections 13(7.1) and 13(7.4)

Paragraph 12(1)(x)

Regulations 1100(2) and (2.2)

Column 4 - Cost of acquisitions from column 3 that are designated immediate expensing property (DIEP)

For each class, enter the total cost of all DIEPs that you acquired during the year. They are included in column 3 and shown separately in column 4.

DIEP generally means a property, other than a property included in classes 1 to 6, 14.1, 17, 47, 49, and 51, acquired by a CCPC after April 18, 2021, and that becomes available for use in the tax year (before 2024).

The property must meet one of the two following conditions:

-

it has not been used and no person or partnership has deducted CCA or a terminal loss for the property

-

it was not subject to a tax-deferred rollover and it was not previously owned or acquired by the eligible person or partnership or a non-arm's length person or partnership

Reference

Regulation 1104(3.1)

Column 5 - Adjustments and transfers

In some cases, you will have to adjust the UCC of a property. In column 5, enter the amounts that will either reduce or increase the UCC.

Reduce the UCC of a property by the following amounts:

-

any amount by which the UCC for the class is required (otherwise than because of a reduction in the taxpayer's capital cost of depreciable property) to be reduced at or before the time of the UCC calculation because of the debt forgiveness rules in subsection 80(5)

-

each amount of ITC allowed on a property for a tax year which has ended before the UCC calculation and after disposition of the property

-

each amount of assistance you received (or were entitled to receive) after the disposition of a property, if such assistance would have decreased the capital cost of the property by virtue of paragraph 13(7.1)(f)

-

each amount you received after February 23, 1998, and before the time of the UCC calculation for a refund of an amount as or on account of a proposed or existing countervailing or anti-dumping duty on a particular property added to the UCC of the class

Add to the UCC of the property:

-

any legally required repayment of assistance made after the disposition of a particular property, that would have otherwise increased the capital cost of the property under paragraph 13(7.1)(d)

-

any legally required repayment of an inducement, assistance or any other amount contemplated in paragraph 12(1)(x) received after the disposition of a particular property, that otherwise would have increased the capital cost of the property under paragraph 13(7.4)(b)

-

each amount payable after February 23, 1998, and paid before the time of the UCC calculation as or on account of a proposed or existing countervailing or anti-dumping duty on a particular property

Also include in column 5 depreciable property transferred on amalgamation or upon the wind-up of a subsidiary, and depreciable property transferred under section 85. Show the amounts that reduce the UCC in brackets. Do not include them as income.

References

Subsection 13(21)

Column 6 - Amount from column 5 that is assistance received or receivable during the year for a property, subsequent to its disposition

Enter the total amount of assistance you received (or were entitled to receive) after the disposition of a property, if such assistance would have decreased the capital cost of the property if received before the disposition by virtue of paragraph 13(7.1)(f).

That amount is included in column 5 because it reduces the capital cost of a property. It is also reported separately in column 6.

References

Subsection 13(21)

Paragraph 13(7.1)(f)

Column 7 - Amount from column 5 that is repaid during the year for a property, subsequent to its disposition

In column 7, include all amounts you have repaid during the year with respect to any legally required repayment, made after the disposition of a corresponding property, of:

-

assistance that would have otherwise increased the capital cost of the property under paragraph 13(7.1)(d)

-

an inducement, assistance or any other amount contemplated in paragraph 12(1)(x) received, that otherwise would have increased the capital cost of the property under paragraph 13(7.4)(b)

These amounts are included in column 5 as they increase the capital cost of a property. They are also reported separately in column 7.

References

Subsection 13(21)

Paragraphs 13(7.1)(d), 13(7.4)(b), and 12(1)(x)

Regulation 1100(2.2)

Column 8 - Proceeds of dispositions

For each class, you usually enter the total proceeds of disposition received or are entitled to be received for property disposed of during the year. However, if you disposed of the property for more than its capital cost, enter the capital cost, not the actual proceeds of disposition.

A capital gain results when you dispose of a depreciable property for more than its capital cost. However, losses on depreciable property do not result in capital losses. They may result in terminal losses. For details about terminal losses, see column 22.

Column 9 - Proceeds of disposition of the DIEP

For any applicable DIEP reported in column 4, enter the total proceeds of disposition if you disposed of it during the year. They are included in column 8 and shown separately in column 9.

Column 10 - UCC

To calculate the amount you have to enter in column 10, do the following:

-

add the amounts in columns 2 and 3

-

either subtract or add the amount in column 5 (subtract if it is a negative amount, or add if it is a positive amount)

-

subtract the amount in column 8

You cannot claim CCA in the following situations:

-

the amount in column 10 is positive, and no property is left in that class at the end of the tax year (a terminal loss)

-

the amount in column 10 is negative (a recapture of CCA)

Terminal loss

A terminal loss results when you dispose of all the property in a particular class and there is an amount of undepreciated capital cost left in column 10. You have to deduct the terminal loss from income. If applicable, enter the positive amount from column 10 in column 22. For details, see example 1 under the heading "Schedule 8 examples" that follows.

Recapture of CCA

If the amount in column 10 is negative, you have a recapture of CCA. A recapture of CCA occurs when the proceeds of disposition in column 8 are more than the total of columns 2 and 3, plus or minus the amount in column 5 of that class.

You have to add the recapture to income. If applicable, enter the negative amount from column 10 in column 21 as a positive. For details, see example 2 under the heading "Schedule 8 examples" that follows.

The recapture and terminal loss rules do not apply to passenger vehicles in class 10.1. However, the recapture rules do apply to a passenger vehicle that was, at any time, a DIEP.

Once you have entered the recapture or terminal loss from column 10 in column 21 or 22, do not complete columns 23 and 24 for that line.

Column 11 - UCC of the DIEP

Enter the UCC amount that relates to the DIEP reported in column 4. That amount should not exceed the UCC amount reported in column 10.

Column 12 - Immediate expensing

The immediate expensing for CCPCs is the lesser of the following two amounts:

-

the immediate expensing limit for the tax year

-

the UCC of the DIEP for the tax year (amount from column 11)

The immediate expensing limit is equal to one of the following five amounts, whichever is applicable:

-

$1.5 million, if the CCPC is not associated (under subsection 1104(3.6) of the Regulations) with any other EPOP in the tax year

-

the immediate expensing limit allocated to the CCPC in Part 1 of Schedule 8, if the CCPC is associated with one or more EPOPs in the tax year and you entered into an agreement with them under subsection 1104(3.3) of the Regulations

-

nil, if the CCPC is associated with one or more EPOPs in the tax year and:

-

the total of the percentages assigned in the agreement is more than 100% or

-

the CCPC has not filed an agreement in prescribed form as required under subsection 1104(3.3) of the Regulations

-

-

the amount determined under subsection 1104(3.5) of the Regulations for any second or subsequent tax years ending in a calendar year, if the CCPC has two or more tax years ending in the calendar year in which it is associated with another EPOP that has a tax year ending in that calendar year

-

any amount allocated by the minister under subsection 1104(3.4) of the Regulations

The immediate expensing limit has to be prorated if your tax year is less than 365 days.

Reference

Regulations 1100(0.1) and 1104(3.1) to (3.6)

Column 13 - Cost of acquisitions on remainder of class

Column 13 represents the cost of acquisitions that are not eligible for the immediate expensing incentive. This includes properties that are not DIEP or are DIEPs that have exceeded the immediate expensing deduction for the tax year.

To calculate the amount you have to enter in column 13, do the following:

-

add the amount in column 3

-

subtract the amount in column 12

Column 14 - Cost of acquisitions from column 13 that are accelerated investment incentive property (AIIP) or properties included in classes 54 to 56

For each class, enter the total cost of the AIIP or properties included in classes 54 to 56 that you acquired during the year. They are included in column 13 and shown separately in column 14.

AIIP generally means a property, other than property included in classes 54 to 56, acquired after November 20, 2018, and that becomes available for use before 2028.

For more details, see "Zero-emission vehicles - Classes 54 and 55", on page 46, "Zero-emission vehicles - Class 56", on page 47, and "Accelerated investment incentive property", on page 48.

References

Regulation 1104(4)

Schedule II of the Regulations

Column 15 - Remaining UCC

Column 15 represents the remaining portion of UCC after applying the immediate expensing deduction. The remaining portion of UCC will be used to calculate the CCA deduction under subsection 1100(1) of the Regulations.

Subtract the amount in column 12 from the amount in column 10 and enter the difference.

Reference

Regulation 1100(0.2)

Column 16 - Proceeds of disposition available to reduce the UCC of AIIP and property included in classes 54 to 56

When you purchase an AIIP or a property included in classes 54 to 56 and a property other than an AIIP and property included in classes 54 to 56 during the year and a disposition occurs, the disposition first offsets the property other than AIIP and property included in classes 54 to 56.

Then it reduces the undepreciated capital cost of the AIIP or the property included in classes 54 to 56.

To calculate the amount you have to enter in column 16, do the following:

-

add the amount in column 8

-

add the amount in column 6

-

subtract the amount in column 13

-

add the amount in column 14

-

subtract the amount in column 7

Reference

Regulation 1100(2)

Column 17 - Net capital cost additions of AIIP and property included in classes 54 to 56 acquired during the year

Subtract the amount in column 16 from the amount in column 14 and enter the difference.

Reference

Regulation 1100(2)

Column 18 - UCC adjustment for AIIP and property included in classes 54 to 56 acquired during the year

You must adjust the remaining UCC (from column 15) to include an accelerated CCA component for accelerated investment incentive property and any property included in classes 54 to 56 that you acquired during the year.

Multiply the net capital cost of additions from column 17 by 0.5 unless a different factor is provided in the legislation.

Reference

Regulation 1100(2)

Column 19 - UCC adjustment for property acquired during the year other than AIIP and property included in classes 54 to 56 (previously known as the 50% rule)

Generally, property acquired during the tax year was only eligible for 50% of the normal maximum CCA for the year. You could claim full CCA for that property in the next tax year.

This 50% rule does not apply to certain property, including AIIP and property included in classes 54 to 56.

To apply the 50% rule, the remaining UCC of the property (from column 15) has to be adjusted. This adjustment is equal to half of the net amount of additions to the class (the net cost of acquisitions minus the proceeds of dispositions). Enter this amount in column 19. For details, see example 3 under the heading "Schedule 8 examples" that follows.

When applying the 50% rule, do not reduce the net amount of additions by the ITC claimed in the previous tax year and included in column 5.

Certain properties acquired through non-arm's-length transfers or butterfly transfers (which occur in the course of certain reorganizations) are exempt from the 50% rule.

The AIIP and property included in classes 54 to 56 are also exempt from the 50% rule. For special rules and exceptions, see Income Tax Folio S3-F4-C1, General Discussion of Capital Cost Allowance.

To calculate the amount you have to enter in column 19, do the following:

-

subtract the amount in column 14 from the amount in column 13

-

subtract the amount in column 6

-

add the amount in column 7

-

subtract the amount in column 8

-

multiply the result by 0.5

References

Regulations 1100(2) and 1100(2.2)

Column 20 - CCA rate

Enter the prescribed rate that applies, as provided for under Part XI of the Regulations. If a specific rate has not been provided for a particular class of property, enter N/A in this column.

Enter a rate only if you are using the declining balance method. In this method, the CCA is calculated by multiplying a constant rate by the diminishing balance every year.

Note

Some asset classes use the straight-line method to

calculate the CCA. In this method, the CCA is calculated

by dividing the original amount by the number of years

that corresponds to the life expectancy of the property.

Therefore, the deducted amount stays the same from one

year to the other (except the first and last year, if the

half-year rule applies for property acquired before

November 21, 2018) and you do not have to enter a rate.

Example

Declining balance method - The capital cost of an asset other than an AIIP, a property included in classes 54 to 56, or a property to which the immediate expensing was applied, is $780,000. The rate for the class is 10% with a half-year rule.

First year:

10% × $780,000 = $78,000

$78,000 ÷ 2 = $39,000 CCA (half-year rule)

Second year:

$780,000 - $39,000 = $741,000 (undepreciated capital cost)

$741,000 × 10% = $74,100 CCA

Third year:

$741,000 - $74,100 = $666,900 (undepreciated capital cost)

$666,900 × 10% = $66,690 CCA

And so on for the following years.

Straight-line method - The capital cost of an asset other than an AIIP, a property included in classes 54 to 56, or a property to which the immediate expensing was applied, is $780,000. The asset's life expectancy is 10 years and the half-year rule does not apply. Therefore, the capital cost allowance will be $78,000 per year ($780,000 ÷ 10).

Class 13 (property that is a leasehold interest) uses the straight-line method (with the half-year rule for property acquired before November 21, 2018).

An accelerated investment incentive applies to class 13 for property acquired after November 20, 2018. See Accelerated investment incentive property on page 48.

If a disposition of all leasehold interests in class 13 occurs during the amortization period, the terminal loss is claimed in the year it occurs if the lessee does not acquire a depreciable property that is a leasehold interest before the end of the year.

For more information on the half-year rule, see Income Tax Folio S3-F4-C1, General Discussion of Capital Cost Allowance.

Column 21 - Recapture of CCA

Enter the amount of recapture from column 10, if applicable. Be sure you include the recapture as income. Enter the total of amounts from column 21 on line 107 of Schedule 1.

The recapture rules do not apply to passenger vehicles in class 10.1. However, recapture does apply to a passenger vehicle that was, at any time, a DIEP.

References

Subsections 13(1) and 13(2)

Column 22 - Terminal loss

Enter the terminal loss from column 10, if applicable.

Deduct the terminal loss from income. Enter the total of amounts from column 22 on line 404 of Schedule 1.

The terminal loss rules do not apply to:

-

passenger vehicles in class 10.1

-

property in class 14.1, unless you have stopped carrying on the business to which it relates

-

limited-period franchises, concessions, or licences in class 14 if, at the time of acquisition, the property was a former property of the transferor or any similar property attributable to the same fixed place of business, and you had jointly elected with the transferor to have the replacement property rules apply, unless certain conditions are met

Reference

Subsection 20(16.1)

Column 23 - CCA

To claim the maximum CCA for each class, for the declining balance method, do the following calculation:

-

add the amount in column 15 and the amount in column 18

-

subtract the amount in column 19

-

multiply the result by the rate in column 20

-

add the amount in column 12

Enter the result in column 23. You do not have to claim the maximum allowable CCA. You can claim any amount up to the maximum.

If the tax year is less than 365 days, prorate the CCA claim for all property except for those classes of property that Regulation 1100(3) excludes. The exceptions in Regulation 1100(3) include:

-

class 14 assets

-

class 15 assets

-

timber limits and cutting rights

-

industrial mineral mines

-

certified productions

-

Canadian film or video productions

-

certain mining equipment in classes 28 and 41

To determine the maximum CCA claim, multiply the maximum CCA for a complete year by the number of days in the tax year divided by 365.

References

Regulation 1100(3)

S4-F15-C1, Manufacturing and Processing

The total of all amounts in column 23 is the CCA claim for the tax year. Deduct this amount on line 403 of Schedule 1.

Notes

If you want to change the amount of CCA claimed in a

tax year, send a written request within 90 days of the

date on the notice of assessment or notice of

reassessment. Only under certain circumstances can the

CRA make adjustments after the 90-day period has

expired.

For more information, see Information Circular IC84-1, Revision of Capital Cost Allowance Claims and Other Permissive Deductions.

Column 24 - UCC at the end of the year

Subtract the amount in column 23 from the amount in column 10 and enter the difference. When there is a recapture of CCA or a terminal loss for a particular class in the year, the undepreciated capital cost at the end of the year is always nil.

Schedule 8 examples

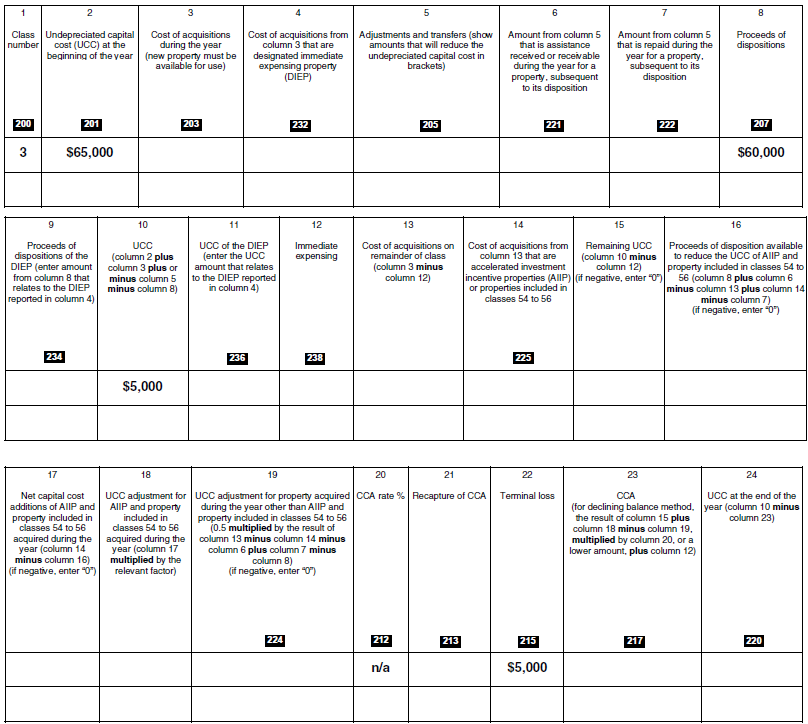

Example 1: Terminal loss

A manufacturing business decided to sell its warehouse because it is better to lease instead. The business received $60,000 for the warehouse. At the end of the 2024 tax year, the business had no more assets in class 3.

The business's Schedule 8 for its 2024 tax year looks like this:

The amount in column 22 is a terminal loss.

The manufacturing business deducts the $5,000 terminal loss from its income (line 404 of Schedule 1).

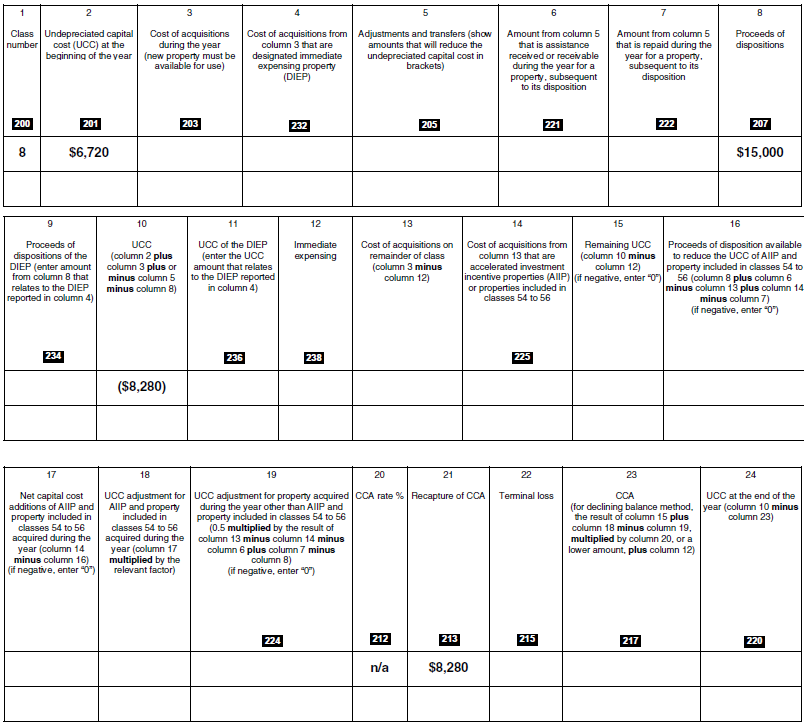

Example 2: Recapture of CCA

A clothing company bought a sewing machine on February 1, 2021, for $15,000. The machine qualified for the accelerated investment incentive. Now, because of the company's overwhelming success in the retail end of the business, it has decided to concentrate solely on retailing. As a result, the company sold its sewing machine in 2024 for $18,000 (but the proceeds of disposition in column 8 cannot be more than $15,000, the capital cost). At the beginning of 2024, the undepreciated capital cost of the sewing machine was $6,720.

The company's Schedule 8 for its 2024 tax year looks like this:

The amount in column 21 is the recapture of CCA.

The clothing company includes the $8,280 recapture in its income (line 107 of Schedule 1). The capital gain is $18,000 minus $15,000, which equals $3,000.

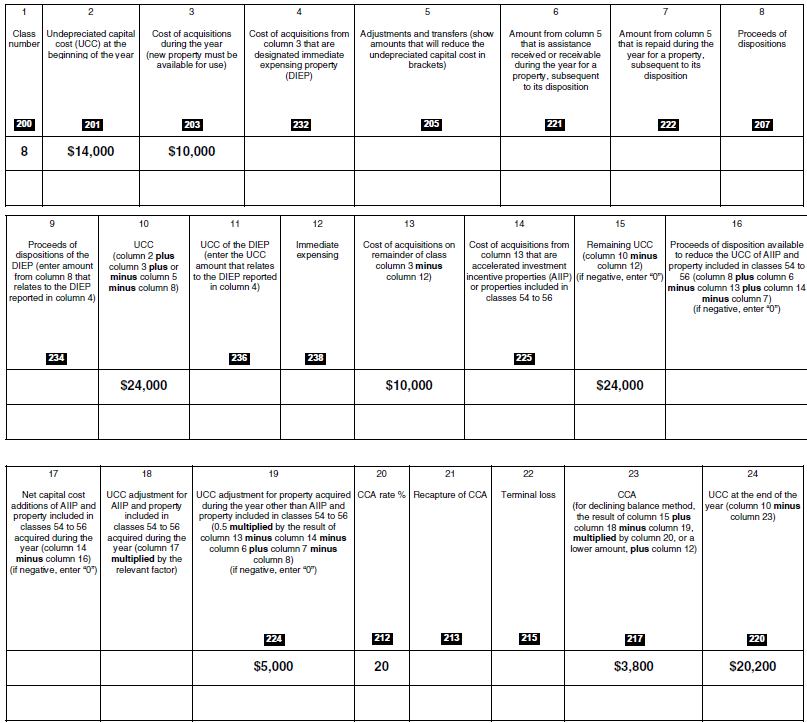

Example 3: 50% rule

In the 2024 tax year, a bookstore bought a photocopier for $10,000 to help keep up with the paperwork, and started using it right away. The vendor was a non-arm's length person who has claimed CCA for the photocopier in a prior tax year. The photocopier is then not considered AIIP. The bookstore has to apply the 50% rule when it calculates the amount of CCA it can deduct for its tax year ending in 2024.

The bookstore's Schedule 8 for its 2024 tax year looks like this:

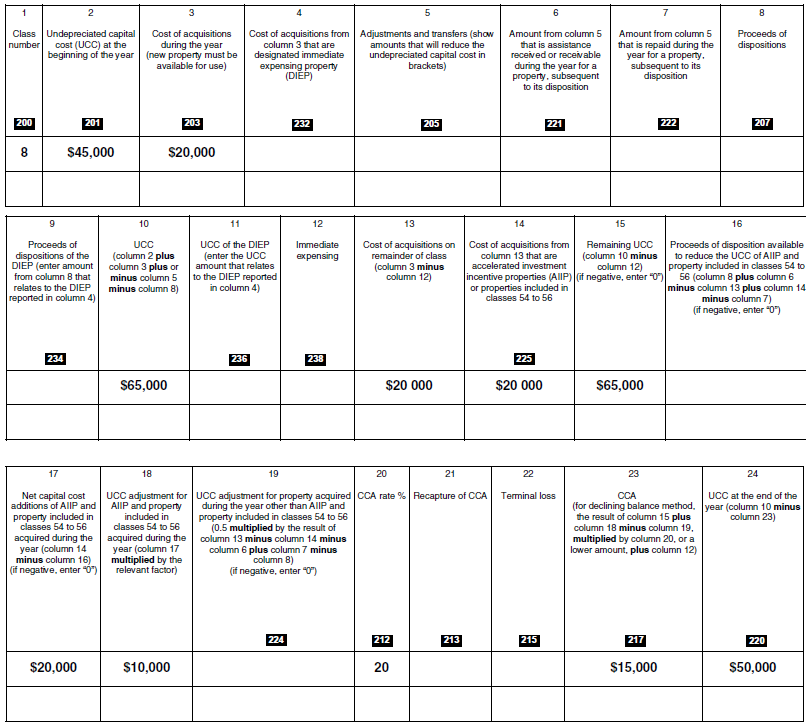

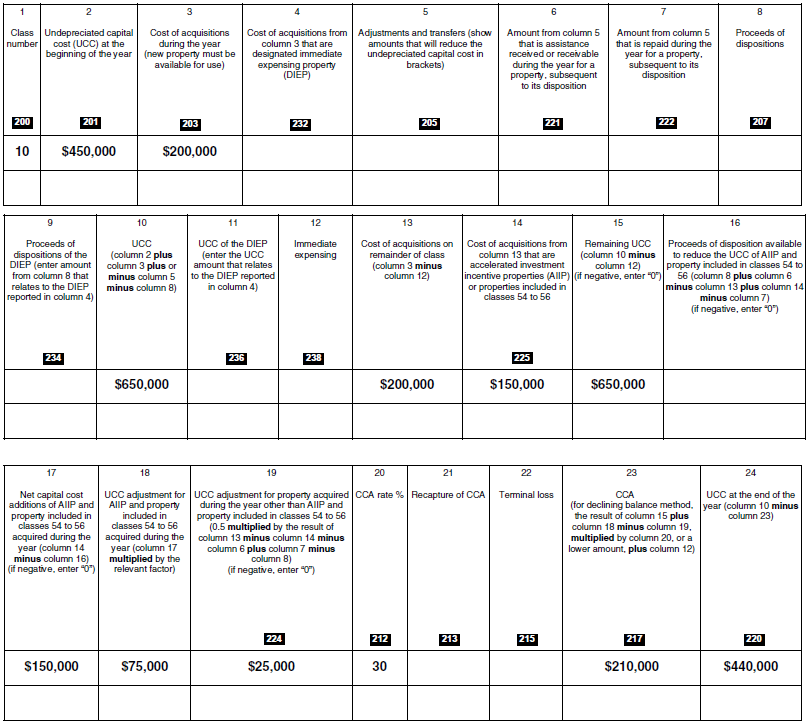

Example 4: Accelerated investment incentive property

A grocery store bought refrigeration equipment to store fruits and vegetables for $20,000 during its 2021 tax year and before April 19, 2021.

All properties bought during the tax year qualify for the accelerated investment incentive and are referred to as AIIP. They are included in columns 3 and 13, and reported separately in column 14.

The amount of AIIP subject to the CCA deduction is $20,000 plus an additional relevant factor of 50% (calculated in column 18) for a total amount of $30,000. AIIP are also not subject to the half-year rule.

Without the accelerated investment incentive, the amount of property bought during the tax year subject to the CCA deduction would be $10,000 as the half-year rule would apply.

The accelerated investment incentive allows the grocery store to claim up to three times the amount of CCA otherwise deductible in the first year.

The grocery store's Schedule 8 for its 2021 tax year looks like this:

Example 5: AIIP and non-AIIP

A potato producer bought tractors for $200,000 during its 2021 tax year and before April 19, 2021. The purchase includes tractors for $50,000 that do not qualify for the accelerated investment incentive because the producer bought them from a non-arm's length person who has claimed CCA for them.

Properties that qualify for the accelerated investment incentive are referred to as AIIP and equal to $150,000. They are included in column 13 and reported separately in column 14.

The amount of AIIP subject to the CCA deduction is $150,000, plus an additional relevant factor of 50% (calculated in column 18) for a total amount of $225,000. AIIP is not subject to the half-year rule.

Properties bought during the year that are not AIIP ($50,000, which is the difference between columns 13 and 14) are not eligible for any enhancement from column 18 and are subject to the half-year rule calculation in column 19.

The producer's Schedule 8 for its 2021 tax year looks like this:

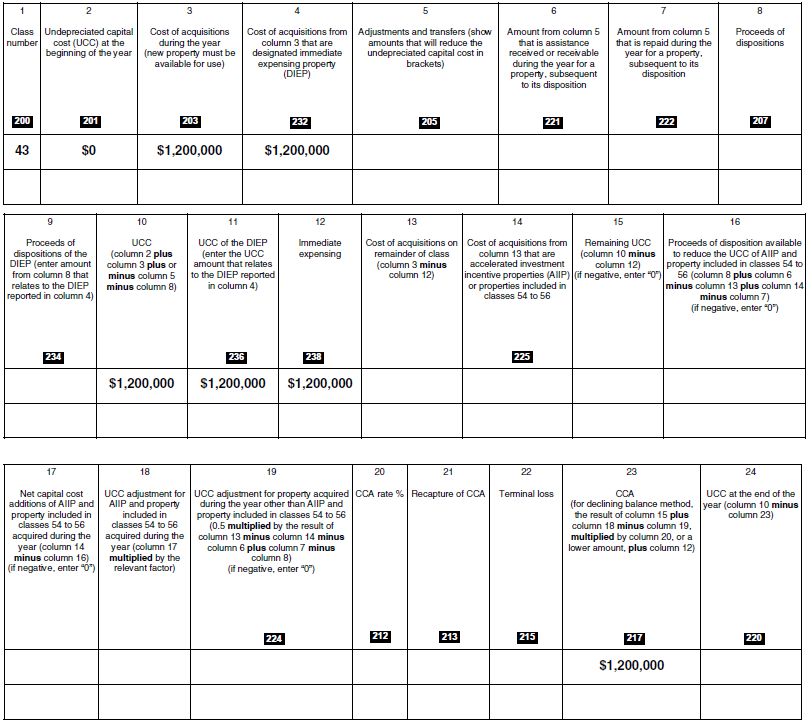

Example 6: Designated immediate expensing property (DIEP)

A new corporation that is a CCPC decides to start manufacturing cars. On May 1, 2023, it bought eligible machinery and equipment for $1.2 million. The corporation is not associated with any other eligible person or partnership (EPOP) during the tax year.

All properties bought during the tax year qualify for the immediate expensing incentive and are referred to as DIEP. Those properties are included in column 3 and reported separately in column 4.

The amount of immediate expensing allowed is the lesser of the immediate expensing limit ($1.5 million) and the UCC of the DIEP ($1.2 million) for $1.2 million. DIEPs are also not subject to the half-year rule.

In this scenario, the immediate expensing incentive allows the corporation to write off the full cost of the asset in the first year.

The company's Schedule 8 for its 2023 tax year looks like this:

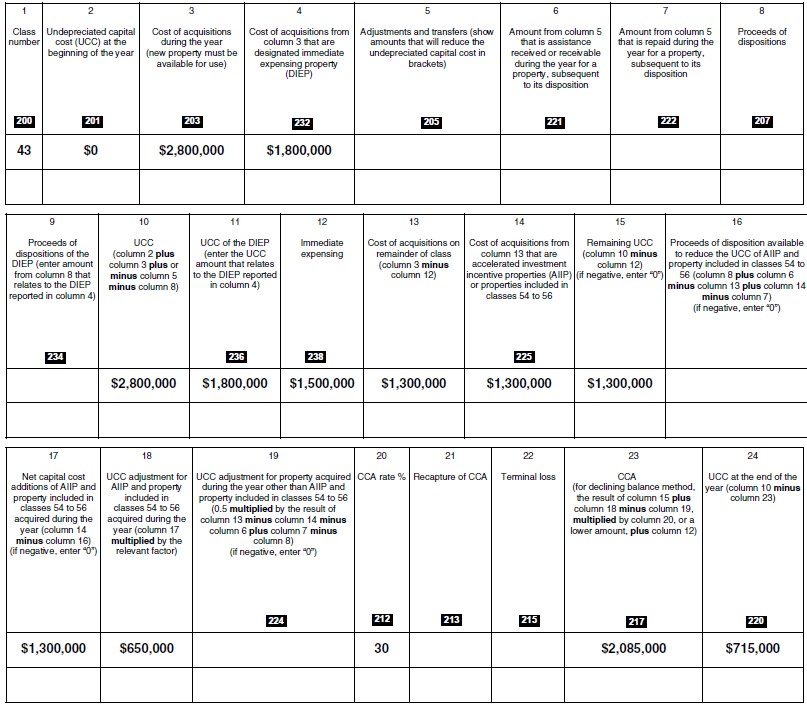

Example 7: DIEP and non-DIEP

A corporation with a tax year starting on July 1, 2023, and ending on June 30, 2024, purchased eligible machinery and equipment on July 1, 2023, for $1 million and July 15, 2023, for $1.8 million. Properties purchased on July 1, 2023, became available for use on February 1, 2024, while properties purchased on July 15, 2023, became available for use on the purchase date. All properties qualify for the accelerated investment incentive. The corporation is not associated with any other eligible person or partnership (EPOP) during the tax year.

DIEPs are properties the corporation acquires after April 18, 2021, that become available for use before 2024. Therefore, the total cost of DIEPs would be $1.8 million. Those properties are included in column 3 and reported separately in column 4.

The amount of immediate expensing allowed is the lesser of the immediate expensing limit ($1.5 million) and the UCC of the DIEP ($1.8 million) for $1.5 million. The remaining $1.3 million, which is made of property not eligible for the DIEP designation (the asset purchased on July 1, 2023, for $1 million) and the remaining portion of the DIEP not eligible for the immediate expensing ($300,000, which is the difference between the UCC of the DIEP of $1.8 million and the $1.5 million immediate expensing), is eligible for the accelerated investment incentive.

The amount of AIIP subject to the CCA deduction is $1.3 million plus an additional relevant factor of 50% (calculated in column 18) for a total amount of $1,950,000, on which the CCA rate of 30% is applied for a result of $585,000. The immediate expensing of $1.5 million is added to that amount to get a total CCA deduction of $2,085,000 in column 23.

The corporation's schedule 8 on June 30, 2024, would look like this:

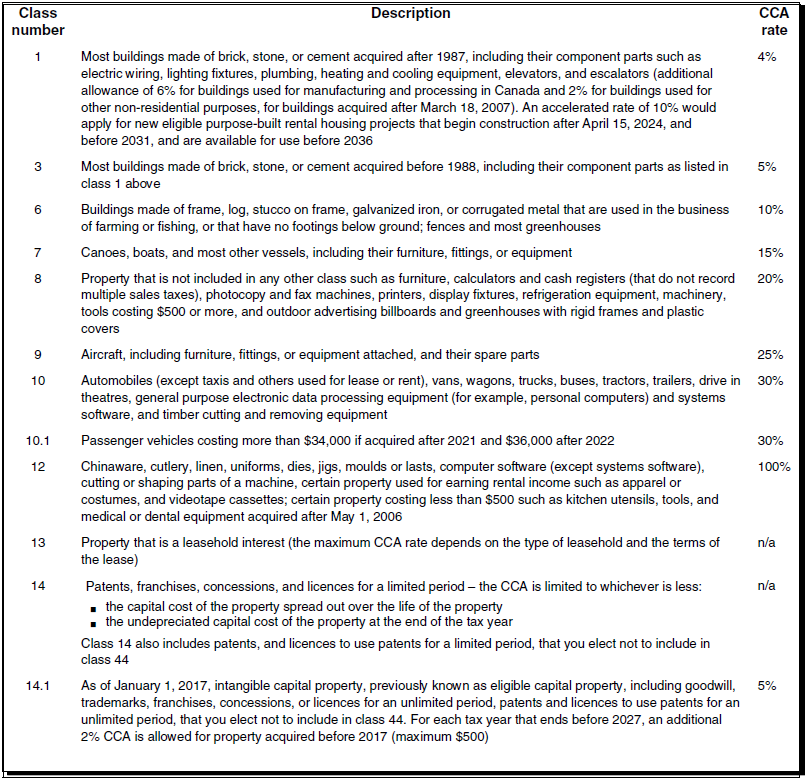

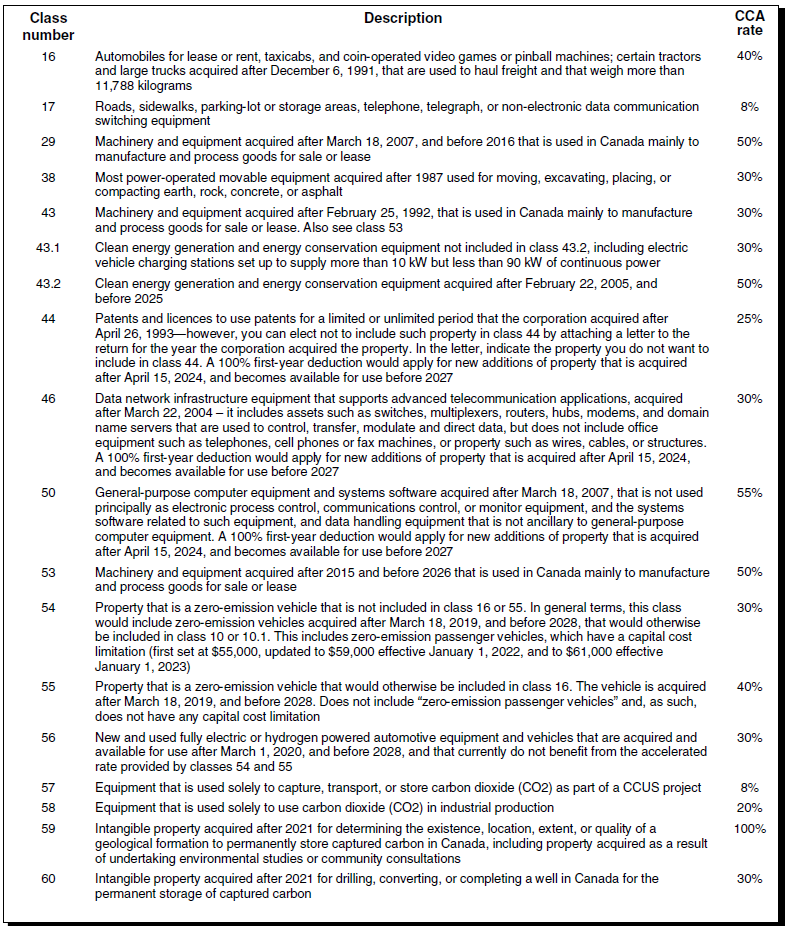

List of CCA rates and classes

The following chart is a partial list and description of the most common capital cost allowance (CCA) classes. You will find a complete list in Schedule II of the Income Tax Regulations.

|

|

|