- What's new in DT FormMax version 4.0?

In this version...

-

Version highlights

-

Periods of pensionable employment for calculation of CPP/QPP contributions

The calculation of the employee's CPP/QPP contributions (in box 16/box 17) on the T4 and RL-1 data entry page now takes into account the number of periods of pensionable earnings for employees who did not work the full year.

In the T4 and RL-1 data entry page for the recipient, select the type of Pay period during which the employee earned a salary or wages (weekly, bi-weekly, monthly, etc.). If the employee did not work for the full year, use the right-click override option on the field Periods of pensionable employment CPP/QPP and enter the applicable number of periods. DT FormMax will then use the amount reported in box 26 – CPP/QPP pensionable earnings, the type of pay period, and the periods of pensionable employment to calculate the employee's CPP or QPP contributions in box 16 or box 17 respectively.

-

Two-dimensional information barcode for Quebec

The government copies of the RL-1, RL-2, RL-3, RL-24 and RL-25 slips now contain the two-dimensional information barcode required for paper filers. DT FormMax automatically creates the two-dimensional barcode on the government copy with the information entered for both the client and the slip recipient.

-

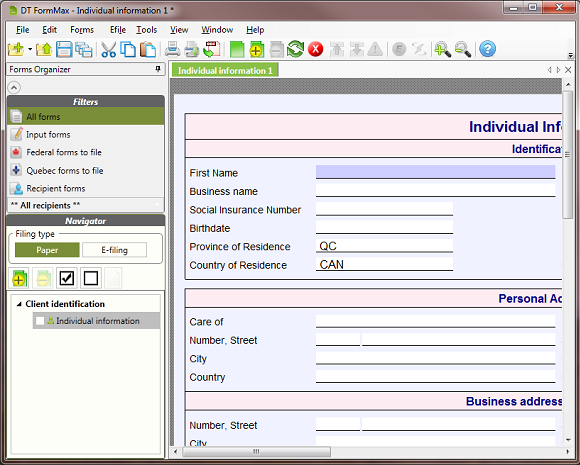

Carryforward of client information

When carrying forward a client's file, the information entered in the Client identification form is automatically carried forward from one year to the next. This information is used to complete the relevant areas of forms added to the client's file. This way, when adding forms in the current year, this common information will automatically be completed. For more information on the steps of the carryforward procedure, click here.

-

Slips and summaries

The Data entry page for each slip recipient entered in the client's file will be carried forward from one year to the next with the recipient's identification information carried forward, saving the need to enter this information again each year. Information entered that is specific to the year, such as box details, will not be brought forward, leaving the data entry page blank to enter the current year's information.

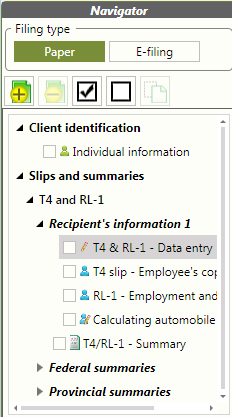

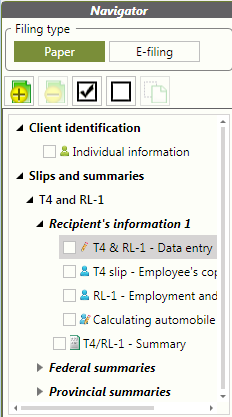

After carrying forward a file, use the new "Show all forms" icon in the Navigator menu, located on the left-hand side (fifth icon from the left, see image below), to view the slips related to the recipients' data entry page. For example, if you have carried forward a client's file with one or more T4 data entry forms and T4 slips, click on the "Show all forms" icon to view the T4 slip in the Navigator.

Then, to include the federal and/or provincial summaries, you need to use the "Add forms" icon (first icon on the left) and select the desired summaries to be included in the current year.

-

RL-24

To comply with the new two-dimensional barcode specifications, the RL-24 slip now contains the information pertaining to three children in version 4.0, instead of four children.

Please take note: If you are carrying forward a client's file with four children (from a previous version), you will need to manually add the fourth child's information in a new data entry page in version 4.0. Similarly, if you are opening a 2012 file created in version 3.0/3.1 in version 4.0, you will need to manually add the fourth child's information in a new data entry page.

-

T4PS and RL-25

The new version of the T4PS Summary now specifically asks for the trustee's name, the employer's name and the employer's address, regardless of which party is completing the form. To facilitate the reporting of this information, a new in-house form, "Employer and Trustee Information" was added to the T4PS and RL-25 group.

If you are carrying forward a client's file with the T4PS/RL-25 forms, use the "Add forms" icon and select "T4PS/RL-25 – Employer, Trustee info" to add this new in-house form to the Navigator.

-

-

New tax for specified employees

The T4PS slip now includes box 40 (Specified employee) and box 41 (Employees profit-sharing plan contributions) to report "the total amount of employer contributions made to the employees profit sharing plan and allocated to the specified employee for actual contributions made after March 28, 2012, unless the contributions are made in relation to a written agreement or arrangement signed before March 29, 2012, where the contributions were made in 2012 but after March 28, 2012. If you are unsure if the employee is a specified employee, leave box 40 blank but enter the amount in box 41, as applicable."

The recipient is instructed to use this amount to determine if he/she has an excess employee profit-sharing plan amount and to calculate the corresponding taxes on Form RC359, Tax on Excess Employee Profit-Sharing Plan Amounts.

It should be noted that no new boxes are added to the latest version of the RL-25 slip (2012-10) to indicate amounts allocated to specified employees, although the new Quebec Special Tax on an Excess Amount Received Under a Profit-Sharing Plan takes the March 28, 2012 date into consideration. Revenu Québec has suggested using a separate RL-25 slip for contributions for the period after March 28, 2012. However, a note may be included with the RL-25 slip so as to provide further instructions for the recipient. A Footnotes section on the T4PS and RL-25 data entry page has been included for this purpose.

-

New in-house form: TPZ-1029.MD.5 - Condominium information

As per clients' request, a new in-house form has been added to the TPZ-1029.MD.5 work chart group to facilitate the reporting of the common information in Part 1 – Identification of the co-owner on the TPZ-1029.MD.5 information return. Specifically, the address information (except the apartment number) will now be automatically propagated from this in-house work chart, leaving only the co-owner's name and apartment number to be completed on the form. Note that the information used to complete Part 2 – Identification of the syndicate now also comes from this new in-house form.

-

-

New features

-

Field note

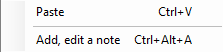

You can now add a note to a field. By right-clicking on the field, the following menu will appear:

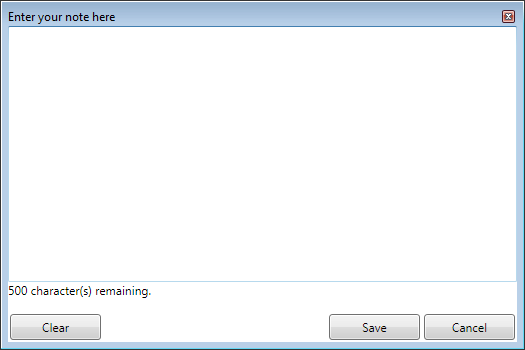

Click on Add, edit a note and the following window will be displayed:

This window allows you to enter a note of up to 500 characters.

You can either save the note or erase it by clicking on Clear.

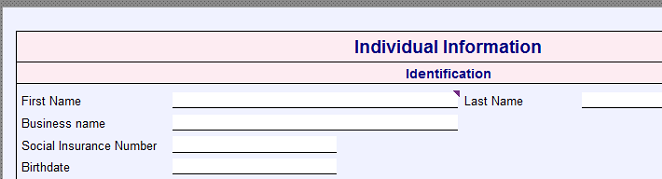

Once the note is saved, in the field for which you entered the note, a triangle will appear on the upper-right side, as shown below:

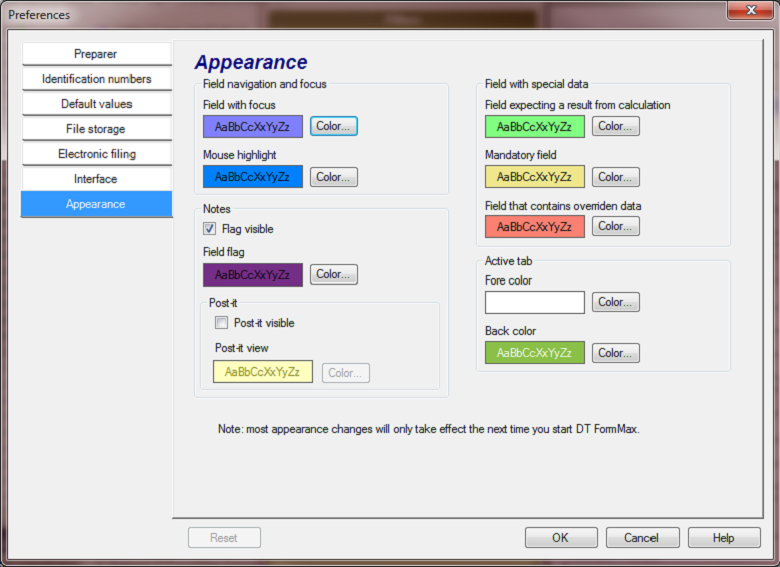

You can activate/deactivate this feature in the Preferences dialog from the Tools menu. To do so, select the Appearance tab, and under Notes check the box for Flag visible.

As you may have noticed on the image above, there is another way for you to view the note without having to right-click and select Edit note. Just go to Tools->Preferences->Appearance, check the box for Post-it visible and you will be able to view the note when you hover your mouse over it.

-

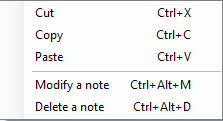

Cut, Copy and Paste in the Field menu

You can now select cut, copy or paste from the right-click menu:

-

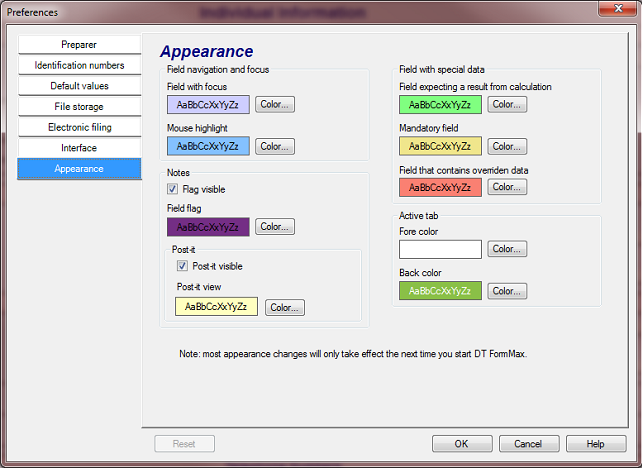

Setting the colour for the active tab

You can now set the active document's colour. To do so, select Tools->Preferences->Appearance.

Under Active tab, select the colour for the fore colour, which means the characters' colour, and the back colour for the background.

This will allow you to view the active tab more accurately:

-

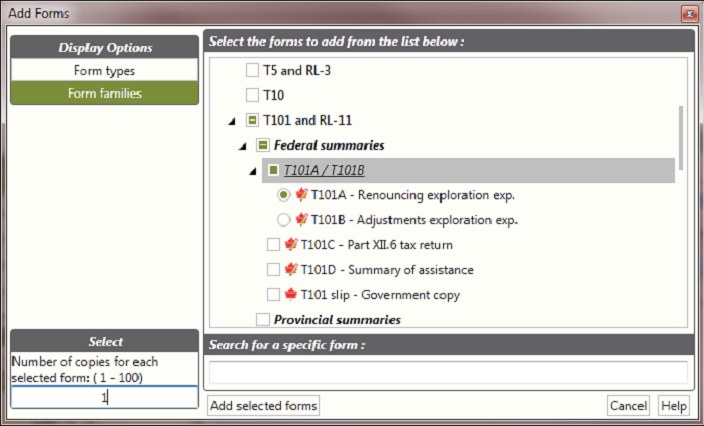

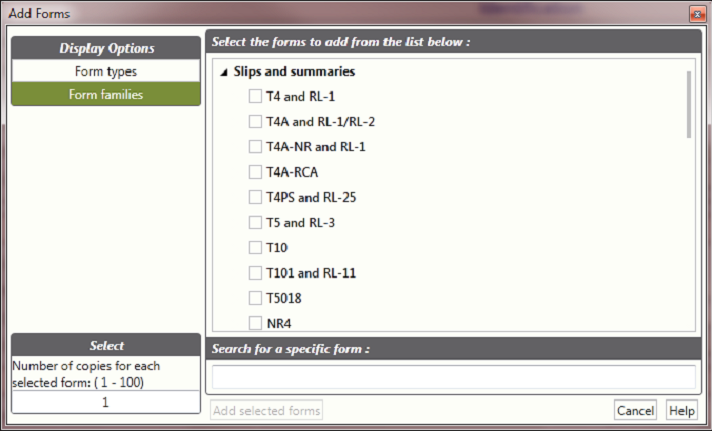

New Form Selector

The Form Selector has been redesigned to support new features like the ability to choose between two forms from a same family.

This feature can make a form exclusive for a particular file, e.g. T101A vs. T101B.

The maximum number of forms that you can add to the current document is limited to 600 per document. Due to current technical limitations, you cannot add more than 100 forms at a time. However, keep in mind that these issues will be addressed in the future.

-

New Form Navigator

The Form Navigator has been redesigned for quicker navigation between the selected forms, and has been optimized to allow the implementation of new features with future releases.

The scrolling has been redesigned and new Select all and Clear selections buttons are now available. However, please keep in mind that if you select a filter and click the button Select all, it will check all items in the Navigator, not only those that are visible. The navigation through the Navigator is now performed with the arrow keys of the keyboard, as well as the Page up, Page down, Home and End keys.

-

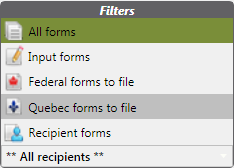

Newly designed Navigator filters

The Form Filter has been redesigned to fix some of the issues like the re-sizing of this window. However, you must keep in mind that the filter is there only for form navigation purposes. This means that, when you select Input, the Navigator will display only the input forms. You cannot use this feature to make some printing selections.

-

Printing only the current page

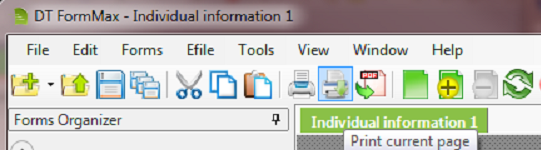

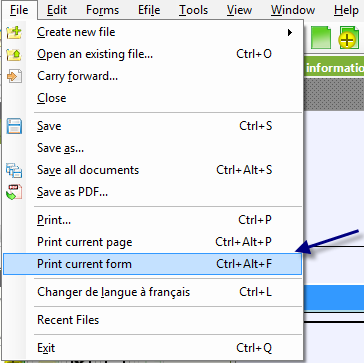

You may print the current page by clicking on the following icon:

Or you can print it by going to File->Print current page, or by using the shortcut key Ctrl+Alt+P.

-

Printing the current form

Likewise, you may choose to print only the current form. You can access this feature as follows:

Or you can use the shortcut key Ctrl+Alt+F to print the current form.

-

Display of licence validation when opening a document

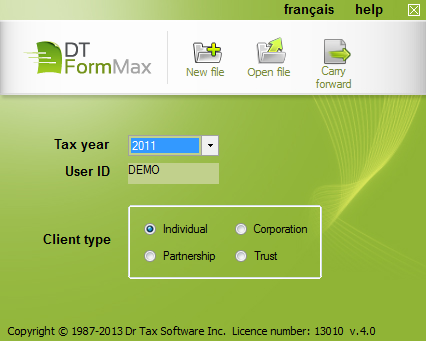

DT FormMax differs significantly from DT Max, because of the multiple documents that DT FormMax can handle. This means that the program will validate the licence for each document that is opened, created or carried forward. If you already have a DT FormMax licence key for 2011, when you start version 4.0, your splash screen will probably appear with the year 2011 as follows:

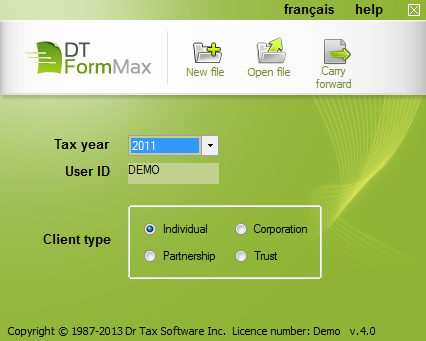

If you look at the bottom of this dialog, you will see that your licence is valid. However, if you select the year 2012 or 2013, the licence will only be shown as Demo version.

This means that you will be able to add forms, perform calculations, carry forward, save and open files, but you will not be able to electronically transmit your file (EFILE) to the government. You will be able to print your file or save it as PDF format, but it will have a "DEMO" watermark across the form.

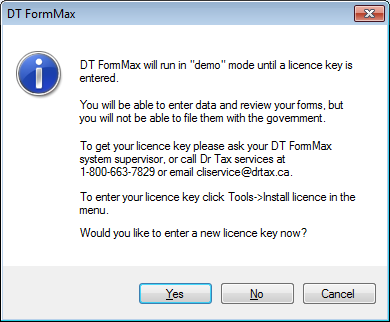

When you start the application, the following dialog will appear:

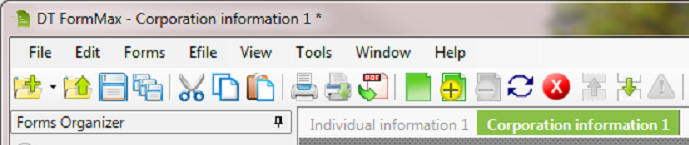

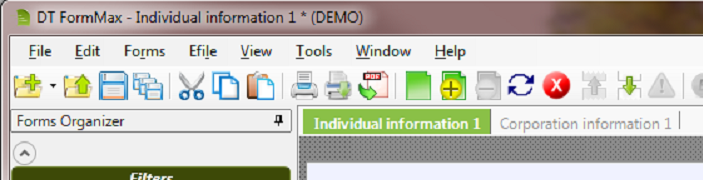

Click "Yes" to enter your new licence key, or "No" or "Cancel" to exit. If you select "No" or "Cancel", you will see the word "DEMO" displayed on the top portion of the screen, that indicates that this document is in "demo" mode. Since DT FormMax handles multiple documents, then you can have an open document which is not in "demo" mode, and another document which is in "demo" mode. In the following example, you can see both types of documents:

Non "Demo Mode" document

"Demo Mode" document

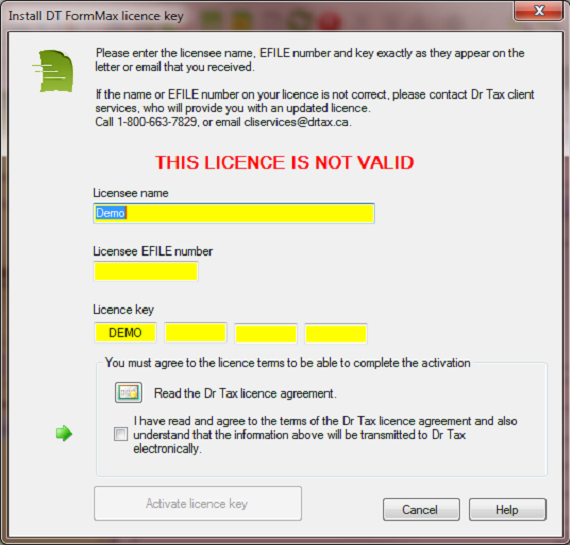

If you selected "Yes" for the previous dialog, you will be prompted with the following licence installation dialog:

-

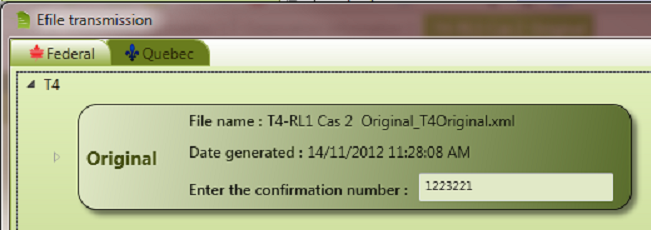

Efile transmission

You can now modify the confirmation number that was previously hidden.

-

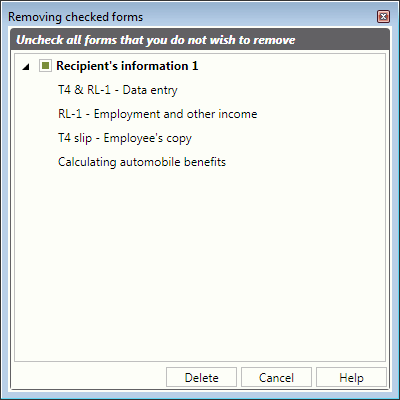

Deleted form acknowledgment dialog

A new dialog box appears when the user wants to delete forms. It will display all the selected forms, so that the user knows which forms he or she is about to delete.

-

-

Enhancements

-

Calculation

The calculation is from now on performed on all forms, so the user doesn't have to select all the forms to have the calculation done, nor does he or she need to refresh the page. Incidentally, note that the Refresh button has been renamed Recalc.

-

Translation

All of DT FormMax's features have been translated to French, including the Form Viewer.

-

-

New and modified forms

in-house forms new forms -

Electronic Filing

The following slips can be electronically transmitted with version 4.0 of DT FormMax:

NR4

T4

T4A

T4A-NR

T5

T5018

RL-1 (T4)

RL-1 (T4A)

RL-1 (T4A-NR)

RL-2 (T4A)

RL-3

RL-11

RL-17

RL-24

RL-25For more information on the steps involved in electronically filing, click here.

-

QuickStart Tutorial

New to DT FormMax? Our QuickStart Tutorial will help you get started. -

January 10, 2013