Manitoba

Manitoba

Manitoba

The higher rate of Manitoba income tax is 12%.

Corporations may be eligible for a small business deduction to reduce all or part of the tax otherwise payable.

The lower rate of Manitoba income tax for small business is 0%.

The income eligible for the small business deduction rate is determined using the Manitoba business limit of $500,000 effective January 1, 2019. It was previously $450,000.

When the business limit changes during the tax year, you have to base your calculation on the number of days in the year that each limit is in effect.

You can use Schedule 383, Manitoba Corporation Tax Calculation, to help you calculate your Manitoba tax before the application of credits. You do not have to file it with your return. See the schedule for more details.

On line 230 of Schedule 5, enter the amount of tax calculated.

Manitoba manufacturing investment tax credit

You can earn this credit on the cost of qualified property. The credit will first be applied to reduce the Manitoba corporation income tax payable. Then you can claim a part of the credit you are entitled to claim in a tax year as a refundable credit.

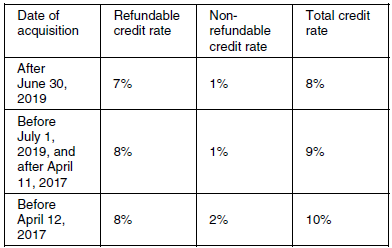

The non-refundable part of the credit is 1% of the cost of qualified property. For property acquired before April 12, 2017, the rate is 2%.

The refundable part of the credit is 7% of the cost of qualified property. For property acquired before July 1, 2019, the rate is 8%.

Under subsection 7.2(7) of the Manitoba Income Tax Act, you can renounce, in whole or in part, the manufacturing investment tax credit earned in the current tax year.

Qualified property includes new and used buildings, machinery, and equipment made available for use in Manitoba primarily for manufacturing or processing goods for sale or lease.

Note

The acquired date for purposes of this credit is the date

that the property became available for use.

Certain green energy equipment is eligible for both the manufacturing investment tax credit and the green energy equipment tax credit (see page 122).

You can carry back an unused non-refundable credit to the three previous tax years from the tax year in which you acquired the property. You can also carry it forward to the 10 tax years that follow the tax year in which you acquired the property.

To claim the credit, file a completed Schedule 381, Manitoba Manufacturing Investment Tax Credit no later than 12 months after your income tax return is due for the tax year in which the expenditures were incurred. For more details, see the schedule.

On line 605 of Schedule 5, enter the amount of the non-refundable credit you are claiming. On line 621 enter the amount of the refundable credit you are claiming.

Manitoba research and development tax credit

You can claim this credit if you have a permanent establishment in Manitoba and you made eligible expenditures for research and development carried out in Manitoba.

The amount of the credit is equal to 15% of eligible expenditures. Eligible expenditures include current expenditures and capital expenditures for depreciable property (other than a building or a leasehold interest in a building) and first term and second term shared-use-equipment.

In addition to the corporation's eligible expenditures, a corporation may claim any repayments of government assistance that are related to eligible expenditures.

The tax credit for research and development carried on in Manitoba under an eligible contract with a qualifying research institute is fully refundable. When eligible research and development is not undertaken under an eligible contract with an institute, 50% of the tax credit amount is refundable, the rest is non-refundable.

Note

Manitoba Finance posted on its website the list of

Educational Institutions Potentially Eligible for

Participation in SR&ED Refundable Manitoba R&D Tax

Credit Program.

You can carry back an unused non-refundable credit to the three previous tax years from the tax year that you made the expenditure in. You can also carry it forward to the 20 tax years that follow the tax year in which you made the expenditure.

You can renounce the research and development tax credit for an eligible expenditure incurred during the year, in whole or in part, under subsection 7.3(7) of the Income Tax Act (Manitoba).

To claim the credit, file a completed Schedule 380, Manitoba Research and Development Tax Credit, with your return. You must identify the eligible expenditures no later than 12 months after your income tax return is due for the tax year in which the expenditures were incurred. For more details, see the schedule.

On line 606 of Schedule 5, enter the amount of the non-refundable credit you are claiming. On line 613 of Schedule 5, enter the amount of the refundable credit.

Manitoba paid work experience tax credit

The Manitoba paid work experience tax credit includes the following:

-

youth work experience hiring incentive (25%, lifetime maximum $5,000)

-

co-op student hiring incentive (15%, lifetime maximum $5,000)

-

co-op graduate hiring incentive (15%, maximum $2,500)

-

apprentice hiring incentive (15%, 20% for rural or northern early level, 25% for high school, maximum $5,000)

-

journeyperson hiring incentive (15%, maximum $5,000)

Employers self-assess salary and wages for qualifying employees based on the fiscal year, as long as the employee is progressing through their co-op or apprenticeship program.

The credit is fully refundable, but it must first be applied against total taxes payable.

To claim the credit, file a completed Schedule 384, Manitoba Paid Work Experience Tax Credit, with your return. For more details, see the schedule.

On line 622 of Schedule 5 enter the amount of the credit you are claiming.

A corporation that is exempt under section 149 of the federal Income Tax Act is also eligible to claim this credit, except Crown corporations and other provincial government entities. Along with Schedule 384, the exempt corporation will also have to complete Schedule 5 and file a T2 return.

Youth work experience hiring incentive

You can claim this credit if you have been approved by the province to provide paid work experience to an individual who has completed an approved high school course or training program.

The credit is equal to 25% of the eligible salary and wages paid to a qualifying youth, less government assistance up to a lifetime maximum of $5,000 per youth.

The eligible employment period of the youth must be completed by the end of the calendar year following the academic year that the youth completed the approved course.

Co-op student hiring incentive

You can claim this credit if you are an employer who provides a work placement for a student enrolled in a qualifying post-secondary co-operative education program.

The credit for each qualifying work placement is 15% of the salary and wages paid to the student for work performed mainly in Manitoba, less government assistance, to a lifetime maximum of $5,000 per student.

The credit will be nil if the student under the work placement has had five previous qualifying work placements.

Co-op graduate hiring incentive

You can claim this credit if you are an employer that has hired co-op graduates in full-time employment in Manitoba. The students must have graduated from a recognized post-secondary co-operative education program in a field related to the employment.

The credit is equal to 15% of the net salary and wages paid to the graduate, less government assistance, in each of the first two full years of employment, to a maximum of $2,500 for each year, where the employment starts within 18 months of graduation.

Apprentice hiring incentive

You can claim this credit if you are an employer who hires high-school and post-secondary apprentices in Manitoba.

The maximum amount of the credit is $5,000 per apprentice per year. Depending on your situation, the rate of salary and wages is:

-

15%, if you do not qualify for any other situation

-

20% for employers of apprentices who normally reside outside of Winnipeg and whose work is performed outside of Winnipeg

-

25% for employers of high school apprentices

This component of the credit also covers employers eligible for the federal apprenticeship job creation tax credit, who will receive a top-up that is equal to the difference between this provincial credit and the federal credit.

Journeyperson hiring incentive

You can claim this credit if you are an employer that has hired recent graduates of apprenticeship programs in full time employment in Manitoba. The journeyperson must have received their certificate of qualification in Canada in a field related to the employment.

The credit is equal to 15% of salary and wages paid to the journeyperson, less government assistance, in each of the first two full years of employment, up to a maximum of $5,000 for each year, where the employment starts within 18 months of certification.

Employment periods must be continuous and consecutive, but an employment period may be interrupted by a seasonal layoff of not more than three months.

Manitoba odour-control tax credit

You can no longer earn this credit, as it was eliminated for expenditures made after April 11, 2017. You can only carry forward the non-refundable, unused, unexpired credit for 10 tax years.

To claim the carryforward, file a completed Schedule 385, Manitoba Odour-Control Tax Credit, with your return. For more details, see the schedule.

On line 607 of Schedule 5, enter the amount of the non-refundable, unused, and unexpired credit carried forward from previous years and applied to reduce tax payable in the current year.

Manitoba small business venture capital tax credit

You can claim this non-refundable tax credit if you are an eligible investor and you meet both of the following conditions:

-

you are a corporation that is not a prescribed venture capital corporation or labour-sponsored venture capital corporation under Part LXVII of the federal regulations

-

you made a direct investment of at least $10,000 in shares the Province has approved as an eligible investment in an eligible small business corporation, as defined in the regulations. Before March 12, 2018, the minimum amount was $20,000

The credit is now permanent.

An eligible small business corporation and its affiliates can have a maximum of 100 full-time equivalent employees for the immediately preceding calendar year or a maximum of $15 million in annual sales for the most recently completed fiscal period.

Eligible small businesses include ventures of commercial crop production in a climate-controlled environment and brew pubs.

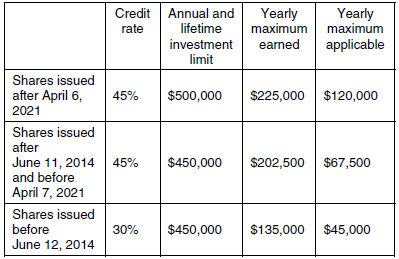

For tax years ending after April 6, 2021, the credit is equal to 45% of the amount invested up to a lifetime maximum investment of $500,000 per company. The maximum amount of the tax credit that you can earn in a year is $225,000 per company. However, the maximum amount of the tax credit that you can apply against provincial tax in the year is $120,000, including any amounts carried back or carried forward.

For eligible shares issued before April 7, 2021, the credit is equal to 45% of the amount invested up to a lifetime and annual maximum investment of $450,000 per company. The yearly maximum applicable is $67,500. For eligible shares issued before June 12, 2014, the rate was 30% and the lifetime and annual maximum investment was $450,000. The yearly maximum applicable was $45,000.

This credit must be claimed against Manitoba tax otherwise payable. You can carry forward unused credits to the 10 following tax years or back to the 3 previous tax years.

The Province of Manitoba will issue a tax credit receipt for qualifying investments. If you file your T2 return electronically, keep your receipt in case the CRA asks for it later. Otherwise, file it with your paper T2 return.

To claim the credit, file a completed Schedule 387, Manitoba Small Business Venture Capital Tax Credit. See the schedule for more details.

On line 608 of Schedule 5, enter the amount of the credit you are claiming.

Manitoba cooperative development tax credit

You can no longer earn this credit, as it was eliminated for contributions made after April 11, 2017. You can only carry forward the non-refundable, unused, unexpired credit for 10 tax years.

To claim the carryforward, file a completed Schedule 390, Manitoba Cooperative Development Tax Credit, with your return.

On line 609 of Schedule 5, enter the amount of the non-refundable, unused, and unexpired credit carried forward from previous years and applied to reduce tax payable in the current year.

Manitoba cultural industries printing tax credit

This refundable tax credit for Manitoba printers is based on the eligible printing costs incurred and paid before 2025 in producing eligible books.

The annual maximum tax credit is $1.1 million per corporation. If two or more eligible printers are related to or associated with each other, the $1.1 million maximum is shared.

The credit is calculated as

tax credit = 35% × L × (R1/R2)

where:

L is the total of the amounts paid by the printer in the tax year, and before 2025, as salary or wages to its employees who were resident in Manitoba on December 31 of that tax year for their employment in the printer's book printing division

R1 is the printer's eligible printing revenue for the tax year

R2 is the total book printing revenue, other than revenue from the printing of yearbooks, earned by the printer in the tax year and before 2025

You can claim this credit if you are engaged in the business of printing books in Manitoba and have a permanent establishment in Manitoba.

All of the following conditions apply:

-

the maximum revenue is capped at $200,000 per book title

-

at least 90% of the book must be new material that has not already been published

-

if the book contains pictures and is not a children's book, at least 65% must be text

-

the printer must demonstrate that the book is for sale through an established distributor

An eligible book is a non-periodical Canadian-authored publication. It is classified as fiction, non-fiction, poetry, drama, biography, or children's. An eligible book must be printed before 2025.

On line 611 of Schedule 5, enter the amount of the credit you are claiming.

Manitoba interactive digital media tax credit

This permanent refundable tax credit is available to a corporation that incurs qualified labour expenditures, as well as some marketing and distribution expenses, towards the Manitoba-based development of eligible interactive digital media products for market.

Effective April 1, 2023, the eligible expenditures were expanded to allow for more flexible forms of employee compensation and incentives as eligible labour expenditures for this tax credit. However, these do not include labour expenditures such as bonuses tied to profits or revenues, stock options or signing bonuses, which are still not eligible.

To claim this credit, a corporation must first apply to Manitoba Economic Development, Investment, Trade, and Natural Resources for a certificate of eligibility. This certificate gives the corporation a preliminary indication as to whether the project will be eligible for the credit and an estimate of the final tax credit amount. The corporation must receive a certificate of eligibility before it can incur eligible expenses.

The corporation must then apply for a tax credit certificate, which is used to claim a tax credit with the CRA. The corporation can apply for this certificate at:

-

the end of every corporate tax year

-

the end of the project

However, if the corporation applies at the end of the project, only the expenses incurred in the current tax year, or the two years immediately preceding the current year, are eligible for a tax credit.

Expenses for eligible projects are to be claimed in the tax year in which they were incurred. Some qualified corporations, in certain circumstances, will be exempt from having to apply for a certificate of eligibility (pre-approval) before project work starts.

An eligible corporation must be a taxable Canadian corporation with a permanent establishment in Manitoba.

The credit is equal to:

-

40% of eligible expenditures, if the corporation pays at least 25% of its total salary and wages to employees who are residents of Manitoba during the year the corporation incurred the eligible project expenses

-

35% of eligible expenditures, if the corporation pays less than 25% of its total salary and wages to Manitoba residents and it incurs at least $1 million in qualifying Manitoba labour expenses during the tax year related to its eligible projects, and provided that these expenses are not already supported by another form of government assistance

Companies may claim up to $100,000 in eligible marketing and distribution expenses directly attributable to a project that meets the requirements to claim marketing and distribution costs.

The eligible activities for this tax credit also include add-on digital media and content that is developed or provided mainly for commercial use and that complements the main product being developed, such as:

-

downloadable content

-

on-going maintenance and updates

-

data management and analysis

When a government or public authority purchases an interactive digital media product, the amount paid by the purchaser and the amount of the interactive digital media tax credit cannot be more than 100% of the project's costs.

Repaid or repayable government assistance and repayable or recoupable Canada Media Fund support do not reduce eligible labour costs.

To claim the credit, file the tax credit certificate with your return no later than the filing due date for the tax year.

The requirement that a corporation claim the credit on or before its filing due date for the tax year is eliminated.

On line 614 of Schedule 5, enter the amount of the credit you are claiming.

Manitoba book publishing tax credit

You can claim this credit if you meet all of the following conditions:

-

are engaged mainly in the business of publishing books or you operate a book publishing business as a university press

-

have a permanent establishment in Manitoba

-

pay at least 25% of the wages and salaries to employees who are Manitoba residents

-

have published at least two eligible books within the two-year period ending at the end of the tax year

An eligible book is a first edition, non-periodical Canadian-authored publication. It is classified as fiction, non-fiction, poetry, drama, biography, or children's.

The credit is equal to 40% of eligible Manitoba labour costs, including non-refundable monetary advances made in the tax year to authors of eligible books, to a maximum of $100,000 per year.

The credit also includes non-refundable monetary advances and labour costs related to publishing an electronic version of an eligible literary work.

An additional bonus of 15% on Manitoba printing costs can be claimed if the book is printed on paper with a minimum of 30% recycled content. For this bonus, eligible printing costs must be incurred and paid in the year of publication or the immediately following calendar year.

The credit is fully refundable. It is now permanent.

To claim the credit, file a completed Schedule 389, Manitoba Book Publishing Tax Credit, no later than 18 months after the end of the tax year for which you are claiming the credit.

On line 615 of Schedule 5, enter the amount of the credit you are claiming.

Manitoba green energy equipment tax credit

The Manitoba green energy equipment tax credit is now permanent.

-

Manufacturer's tax credit

-

geothermal heat pump systems (7.5% of 125%)

-

green energy transmission equipment (8% of 125%)

-

-

Purchaser's tax credit

-

geothermal heat pump systems

-

energy equipment excluding geothermal heat pumps (15%) if the installer is certified by the Manitoba Geothermal Energy Alliance, Inc.

-

heat pump (7.5%)

-

-

solar heating (10%)

-

gasification equipment (15%)

-

energy co-generation equipment from biomass (15%)

-

Manufacturer's tax credit

You can claim this credit if you manufacture and sell geothermal heat pumps for use in Manitoba.

Manufacturers can claim a 7.5% tax credit on the adjusted cost of geothermal heat pump systems that meet the standards set by the Canadian Standards Association.

Adjusted cost means an amount equal to 125% of the manufacturer's cost of manufacturing the heat pump.

Manufacturers can also claim an 8% tax credit on the adjusted cost of green energy transmission equipment sold.

The Manitoba manufacturing investment tax credit (page 118) includes a credit for green energy transmission equipment.

This credit is refundable, but must first be applied against total taxes payable.

On line 619 of Schedule 5, enter the amount of the credit earned in the year.

Purchaser's tax credit

You can also claim this credit if you buy qualifying property that is used to produce energy in Manitoba from a renewable resource. The rate varies with different classes of property and is prescribed by legislation.

Purchasers can claim a credit on geothermal heat pump systems that meet the standards set by the Canadian Standards Association. The tax credit equals the total of:

-

15% of the capital cost of geothermal energy equipment, excluding the cost of the heat pump

-

7.5% of the purchase price of a heat pump that qualifies for the manufacturer's geothermal energy equipment tax credit

Purchasers who install new specified solar heating equipment in Manitoba qualify for a refundable 10% credit on the eligible capital costs (including taxes and costs related to acquiring and making the system operational). The equipment does not include equipment used to heat water for use in a swimming pool or equipment that distributes heated air or water in a building.

The purchaser's credit also includes gasification equipment and certain equipment used for co-generation of energy from biomass that are installed in Manitoba and used in a business. The tax credit rate is 15%.

This credit is refundable, but must first be applied against total taxes payable.

On line 619 of Schedule 5, enter the amount of the credit earned in the year.

Manitoba film and video production tax credit

Manitoba Film and Music reviews all tax credit applications and will issue a tax credit certificate to a corporation that produces an eligible film in the province.

The credit is based on labour costs or production costs.

Credit based on labour costs

The credit is equal to 45% (65% with bonuses) of eligible salaries paid for work performed on an eligible film.

The percentage of eligible salaries paid to non-residents for work performed in Manitoba is 30% of eligible salaries paid to Manitobans when there are two Manitoba trainees for each eligible non-resident in the film production technical crew. However, it is 10% of eligible salaries paid to Manitobans when there is only one Manitoba trainee for each eligible non resident.

The following bonuses are available:

-

a 10% frequent filming bonus on the third eligible film, for corporations that produce three eligible films in two years. This also applies to serial productions

-

a 5% rural filming bonus on eligible salaries paid for work performed in Manitoba on productions where at least 50% of filming days take place at least 35 kilometres outside of Winnipeg

-

a 5% Manitoba producer bonus on eligible salaries where a Manitoba resident receives credit as a producer on an eligible film

Credit based on production costs

Instead of claiming the credit based on labour costs only, corporations may elect to claim a 30% tax credit based on production costs incurred for labour, goods, and services provided in Manitoba that are directly attributable to the production of an eligible film.

For productions for which principal photography begins after May 31, 2020, the Manitoba production company bonus of 8% is added to the 30% cost-of-production credit, increasing the total cost-of-production credit to 38%. The production company must own, otherwise than by way of security, voting shares of the corporation and receive credit as a producer, co-producer, or executive producer of the film.

The cost-of-production credit also includes eligible accommodation expenditures of up to $300 (including tax) per night for a residence or a hotel room in Manitoba.

This credit is fully refundable, but must first be applied against total taxes payable.

To claim the credit, for each eligible film, file the following with your return for the tax year:

-

a Certificate of Completion (if the production was completed in the tax year), or an Advance Certificate of Eligibility (if the production was not completed in the tax year), issued by Manitoba Film and Music

Note

Film producers are able to get advance credits before the completion of a film if they submit the proper documents. -

a completed copy of Schedule 388, Manitoba Film and Video Production Tax Credit

-

all the additional documents listed on the last page of Schedule 388

If you file your return electronically, see information on T2 Attach-a-doc on page 12.

If you file a paper return, send the return and required attachments to your tax centre. To find your tax centre, go to canada.ca/cra-tso-contact-information.

Corporations may file Form T2029, Waiver in Respect of the Normal Reassessment Period or Extended Reassessment Period, to extend the application for a Certificate of Completion with the Manitoba certifying authority by 18 months.

On line 620 of Schedule 5, enter the amount of the credit earned in the current year.

Manitoba data processing investment tax credits

The Manitoba data processing investment tax credits are completely eliminated for the 2025 and later tax years.

Note

The Manitoba data processing investment tax credits are

eliminated for property purchased or leased after

April 11, 2017. However, you may be able to claim a

credit on data processing buildings acquired or

constructed, as well as data processing centre property

acquired after April 11, 2017, if you acquired it to replace

qualified property for which the corporation was

entitled to claim the data processing centre (operator)

credit before April 12, 2017.

The Manitoba data processing investment tax credits include the following three credits:

-

the data processing centre investment tax credit for operator

-

the data processing centre investment tax credit for building lessor

-

the data processing property investment tax credit

Data processing centre (operator)

The Manitoba data processing centre investment tax credit for operator is a refundable credit available to corporations with a permanent establishment in Manitoba whose primary business activity, including the activities of their affiliates, is data processing.

The tax credit is equal to 4.5% of the capital cost of a new data processing building and 8% of the capital cost of new or refurbished data processing centre property. The company must have acquired this property for use in its data processing centre in Manitoba and the property must be available for use.

Data processing centre (building lessor)

The credit also applies to new data processing centres built or acquired in Manitoba, and leased to an eligible corporation that is dealing at arm's length with the lessor. This part of the credit is the Manitoba data processing centre investment tax credit for building lessor.

Data processing property

The Manitoba data processing property investment tax credit is a refundable credit for eligible corporations equal to 8% of the cost of data processing property purchased or leased in the current tax year. To be eligible for this credit, the total cost of data processing property purchased or leased in the year has to be at least $10 million.

The company must purchase or lease the property for use in its data processing centre in Manitoba and the property must be available for use. The corporation does not have to be primarily engaged in data processing in Manitoba, as long as it has a permanent establishment in Manitoba.

These credits also apply to data processing centres built by partnerships. The corporation can claim its proportionate share of the credit that the partnership would earn, if the partnership were a taxable Canadian corporation. To claim the entire amount of the credit, the corporation has to file an election, along with a written consent of the partnership, with its return.

To claim the credits, file a completed Schedule 392, Manitoba Data Processing Investment Tax Credits, with your return.

On line 324 of Schedule 5, enter the total amount of the credit you are claiming.

Manitoba rental housing construction tax credit

A new credit regarding rental housing construction has been introduced, the Manitoba rental housing construction incentive tax credit. See page 124.

This tax credit is equal to 8% of the capital cost of an eligible rental housing project.

Projects in which the application is submitted before March 13, 2018, must be made available for use before 2020. For applications submitted after March 12, 2018, and before 2019, the project must be made available for use before 2021. Applications are no longer accepted after 2018.

Eligible projects means the construction or conversion from a non-residential use, of a building, group of buildings, or portion of a building, with at least five or more new residential rental units, and with at least 10% of the units qualifying as affordable rental housing units. The maximum credit is set at $12,000 per eligible rental unit.

Manitoba Housing and Community Development used to review all tax credit applications and issue a tax credit certificate to corporations that built eligible rental housing projects.

Note

The minister responsible for this credit is the minister

appointed to administer the Manitoba Housing and

Renewal Corporation Act. It was previously the minister

of Housing and Community Development.

Eligible landlords can operate as a for-profit or not-for-profit corporation, but must be residents of Manitoba or have a permanent establishment in Manitoba.

Eligible not-for-profit projects received a fully refundable tax credit in the year in which they earned the tax credit, as the project became available for use. You can no longer claim the refundable credit. The tax credit on for-profit projects is claimable over a maximum of five years, and is non-refundable.

To claim the credit, file a completed Schedule 394, Manitoba Rental Housing Construction Tax Credit, with your return. You do not have to file the certificate with your return. However, keep it in case the CRA asks for it later. Tax-exempt corporations also have to file a return in order to claim this credit.

On line 602 of Schedule 5, enter the amount of the non-refundable, unused, and unexpired credit carried forward from previous years and applied to reduce tax payable in the current year.

Manitoba community enterprise development tax credit

Corporations with a permanent establishment in Manitoba that pay at least 25% of their payroll to Manitoba residents are eligible to acquire tax-creditable shares when they invest in specific community enterprises or in community development investment pools in their communities. The issuer of the shares is responsible for issuing a T2CEDTC (MAN.) receipt to the corporation for that investment. The receipt contains a unique serial number provided by the Manitoba government.

This refundable credit is equal to 45% of a maximum annual investment of $60,000. The credit is now permanent.

If you file electronically, keep your receipt in case the CRA asks for it later. Otherwise, file your receipt with your paper return.

On line 327 of Schedule 5, enter the total amount of the credit you are claiming.

Manitoba child care centre development tax credit

This refundable income tax credit applies to the creation of licensed child care centres.

Manitoba will issue a tax credit certificate to taxable private corporations that create new child care centres. The credit can reach $10,000 over five years per infant or preschool space created. The corporation must not be primarily engaged in child care services.

On line 889 of Schedule 5, enter the certificate number and on line 328, the amount of the credit you are claiming.

Manitoba rental housing construction incentive tax credit

Effective for the 2024 tax year, a new refundable tax credit is introduced that will provide:

-

$8,500 for the construction of new market-rate rental units

-

$13,500 for units classified and maintained as affordable units for a period of at least 10 years

Construction must start on or after January 1, 2024.

Non-profit entities can claim this tax credit in the year the eligible rental housing project becomes available for use. For-profit entities can claim $8,500 on all units in the year the eligible rental housing project becomes available for use, and an additional $5,000 over 10 years for affordable units.

The minister appointed to administer the Manitoba Housing and Renewal Corporation Act may issue a tax credit certificate to a qualifying entity in relation to one or more eligible rental housing projects.

To claim the credit, when available, file a completed Schedule 395, Manitoba Rental Housing Construction Incentive Tax Credit, with your return. You do not have to file the certificate with your return. However, keep it in case the CRA asks for it later.

On line 329 of Schedule 5, enter the amount of the credit you are claiming.

|

|

|