Chapter 2 - Completing the T3 return

Chapter 2 - Completing the T3 return

The T3 return is a five-page form with related schedules. The following information will help you to complete the return.

Note

Due to the nature of bare trusts, not all information

requested on the T3 return is required. Refer to specific

instructions for bare trusts at the end of Step 1.

Step 1 - Identification and other required information ▲

Complete all items on page 1 of the T3 return. The assessment of the return may be delayed if you do not provide all the information.

If this is the first year of filling a T3 return, you may register for a trust account number online using the Trust account registration service through one of the Canada Revenue Agency (CRA)'s secure portals (see page 79).

If this is the first year filing a T3 return, send us a copy of:

-

The trust document or last will and testament (unless already filed with the T3 APP, or sent after completing the online trust account registration process).

Trust account number - If we have assigned an account number to the trust, enter it in this space. Include this number on all correspondence related to the trust. If this is the first return for the trust, we will issue an account number, which will appear on the notice of assessment.

Name of trust - Use the same name on all returns and correspondence for the trust. The name of the trust will be modified to meet our requirements if it is longer than 60 characters. For guidelines on what name to use for a bare trust see "What to file - Instructions for bare trusts" on page 29.

Residence of trust - A trust resides where its real business is carried on, which is where the central management and control of the trust actually takes place. For information about the residence of a trust or estate, see Income Tax Folio S6-F1-C1, Residence of a Trust or Estate.

Trustee Information - Enter the full name of the trustee. If the trust has more than one trustee, choose one trustee to be the CRA's primary contact. The trustee can be an individual or a non-individual. Choose only one of the two options and fill in the required information about the trustee. If the trustee is a non-individual then enter the full name of the contact person.

Mailing address - We may modify part of your address to meet Canada Post's requirements. Therefore, the address on any cheques or correspondence we send you may be different from the one you indicate on the trust's return. If you include the name and mailing address of a contact person, we will send any cheques or correspondence for the trust in care of that person.

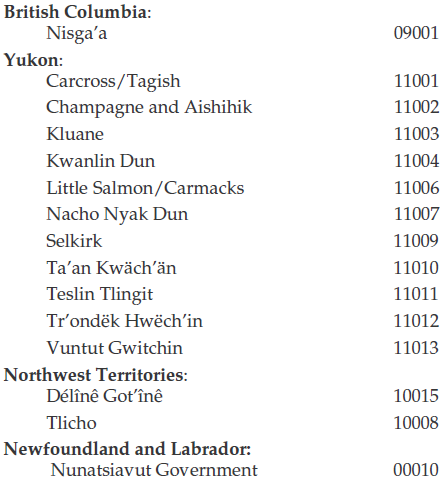

Designated Aboriginal settlement lands - If the trust resides on designated Aboriginal settlement lands, answer yes, and enter the name and settlement number in the spaces provided.

The settlement lands and their numbers are as follows:

When you enter this information on the return, we will transfer part of any tax payable to the government of the Aboriginal settlement where the trust resides.

Date of residency - Provide the date the trust became a resident of Canada or ceased to be a resident of Canada during the tax year, if applicable.

Deemed resident trust - Indicate if the trust is a deemed resident trust and provide the name of any other country in which the trust is considered to be resident. See the definition of a deemed resident trust in "Chart 1 - Types of Trusts" on page 11.

Type of trust - It is important that you complete this section correctly because we use this information to determine the correct rate of tax. To identify the correct type of trust, see "Chart 1 - Types of Trusts" beginning on page 10 and "Code number for the type of trust" on page 17. This information is mandatory. If this information is not entered, the process of the T3 return may be delayed.

Note

If you enter inter vivos code 300, for other trust, you

must specify the type of trust on the "Other inter vivos

trust (specify)" line.

Date of death (if the trust is a testamentary trust) or Date trust was created (if the trust is an inter vivos trust) - Provide this information on each return.

Social Insurance Number of the deceased - If the trust is a testamentary trust, enter the Social Insurance Number of the deceased. The Social Insurance Number of the deceased individual is mandatory for graduated rate estates.

Non-profit organization - If the non-profit organization is incorporated, enter the business number and program account.

|

|

|