Line 20 - Allowable business investment loss (ABIL)

Line 20 - Allowable business investment loss (ABIL)

Line 20 - Allowable business investment loss (ABIL)

If the trust had a business investment loss, you can deduct a part of that loss from income. The deductible portion is called an allowable business investment loss (ABIL).

A business investment loss results from the actual or deemed disposition of certain capital properties. This can happen if the trust has disposed of, or is deemed to dispose of, one of the following to a person with whom it deals at arm's length:

-

a share or debt of a small business corporation

-

a bad debt owed to it by a small business corporation

For more information, see Guide T4037, Capital Gains.

You can deduct the ABIL from the trust's other sources of income for the year. If the ABIL is more than the other sources of income for the year, the difference is a non-capital loss for the year. For more information, see "Line 35 - Non-capital losses of other years"on page 37. Note that, when claiming unused ABILs in the carry-back or carry-forward period, ABILs are not adjusted to account for the inclusion rate that applies in the year the loss is claimed.

If you cannot deduct the ABIL as a non-capital loss within the allowed time frame, the unapplied part becomes a net capital loss in the 11th year. You can then use it to reduce the trust's taxable capital gains in the 11th year or any following year. See "Line 36 - Net capital losses of other years"on page 37.

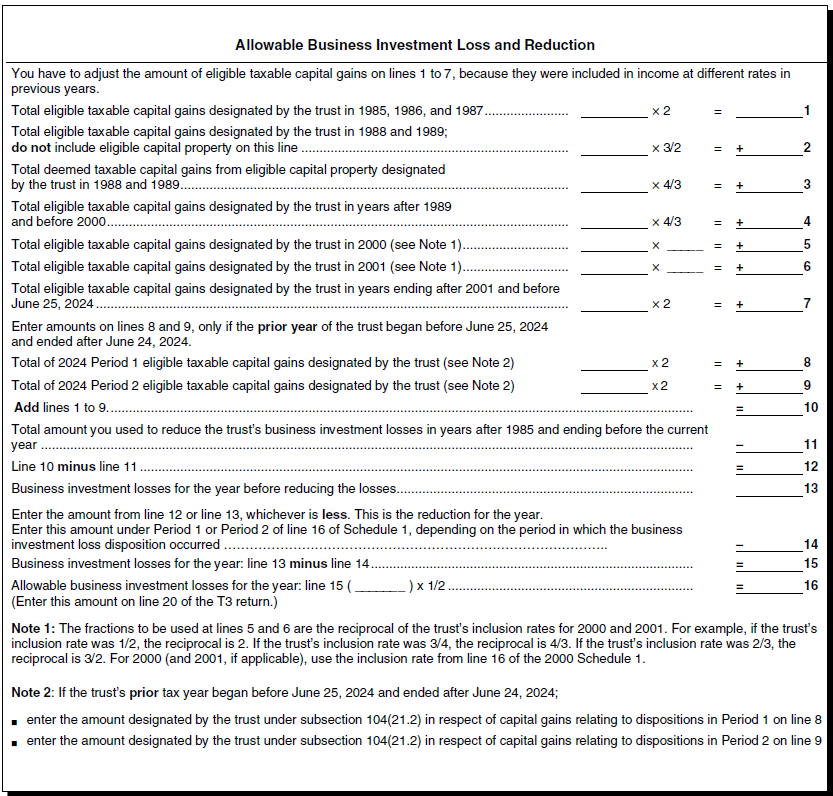

Reduction in business investment loss - If the trust designated part or all of its eligible taxable capital gains for the purpose of the capital gains deduction to a beneficiary in a previous year, you have to reduce the business investment loss for the current year.

Use the chart on the next page to calculate the reduction in business investment loss. If the trust had more than one business investment loss in the year, use this chart to calculate the total reduction. For more information, see Income Tax Folio S4-F8-C1, Business Investment Losses.

|

|

|