Line 25 - Allowable federal political contribution tax credit

Line 25 - Allowable federal political contribution tax credit

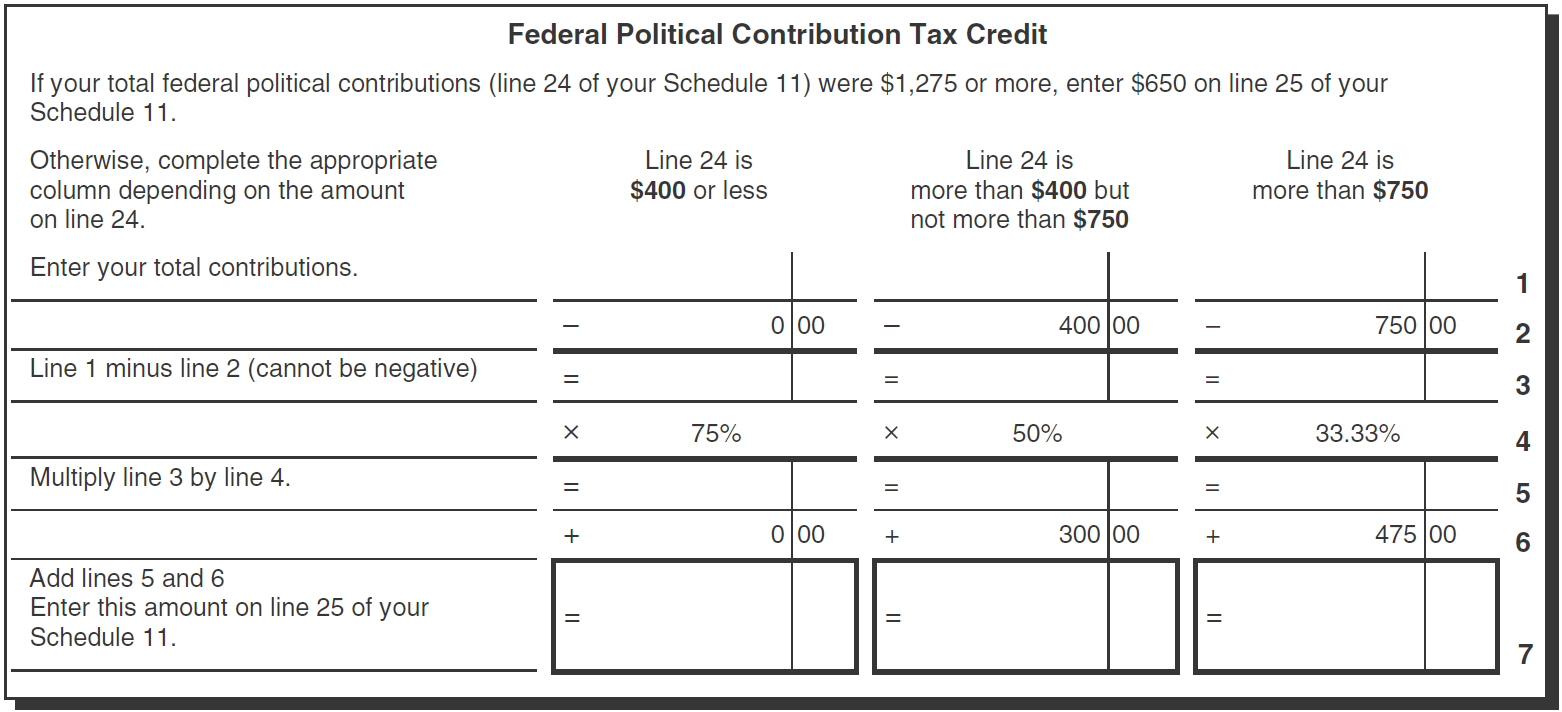

Claim the federal political contributions tax credit for the eligible amount of monetary contributions to a registered party, a registered association, or a candidate, as defined in the Canada Elections Act. Use the chart on the next page to calculate the credit.

Enter the total allowable credit on line 25. If the trust's total eligible federal political contributions are $1,275 or more, enter $650 on line 25. Send us an official receipt as proof of the contribution. You do not have to send us a receipt for an amount shown in box 36 of a T5013 slip, or in a financial statement showing an amount a partnership allocated to the trust. For more information, see Information Circular IC75-2R, Contributions to a Registered Party, a Registered Association or to a Candidate at a Federal Election.

|

|

|