Schedule 9 - Income Allocations and Designations to Beneficiaries ▲

Schedule 9 - Income Allocations and Designations to Beneficiaries ▲

Complete this schedule if the trust is allocating income to its beneficiaries. You also have to complete T3 slips and a T3 Summary if you are allocating income to resident beneficiaries, and NR4 slips and an NR4 Summary if you are allocating income to non-resident beneficiaries.

Allocations and designations ▲

Generally, you allocate income to the trust's beneficiaries according to the terms of the will or trust document. Depending on the type of income allocated, you may then designate all or part of the allocated amount. When you designate an amount to a beneficiary, the type of income keeps its identity. This may allow the beneficiary to take advantage of a deduction or credit that applies to that income (such as the capital gains deduction or the dividend tax credit).

We define "Allocate, allocation" on page 5 and "Designate, designation" on page 6.

You can choose to designate the following income amounts to a beneficiary:

-

net taxable capital gains

-

certain lump-sum pension income

-

dividends from taxable Canadian corporations

-

foreign business income

-

foreign non-business income

-

pension income that qualifies for the pension income amount

-

pension income that qualifies for acquiring an eligible annuity for a minor beneficiary

-

retiring allowances that qualify for a transfer to a registered pension plan (RPP) or a registered retirement savings plan (RRSP)

Note

An insurance segregated fund trust has to designate all of its capital gains and losses to its beneficiaries.

Use Part B of Schedule 9 to report designated amounts. This includes amounts such as foreign income tax paid, a retiring allowance qualifying for transfer to an RPP and an RRSP, a Part XII.2 tax credit, and other tax credits that flow through to the beneficiary.

Income allocated to a beneficiary that is not deductible should not be reported on Schedule 9.

For more information, see the following archived interpretation bulletins:

-

IT-342, Trusts - Income Payable to Beneficiaries

-

IT-381, Trusts - Capital Gains and Losses and the Flow-Through of Taxable Capital Gains to Beneficiaries

-

IT-524, Trusts - Flow-Through of Taxable Dividends to a Beneficiary - After 1987

Split Income

Tax on split income of a minor beneficiary

If a trust (other than a communal organization or a mutual fund trust as described in "Chart 1 - Types of Trusts" on page 9) allocates certain types of income to a beneficiary during the beneficiary's tax year and the beneficiary had not attained the age of 17 before the tax year, the beneficiary may have to pay a special tax (the tax on split income).

The tax on split income applies to all of the following:

-

taxable dividends allocated by the trust (other than dividends from shares of a class listed on a designated stock exchange and those of a mutual fund corporation)

-

shareholder benefits allocated by the trust (other than from ownership of shares of a class listed on a designated stock exchange)

-

for taxation years before 2018, income allocated by the trust that came from providing services or property to, or in support of, a business operated by:

-

a person who is related to the beneficiary at any time in the year

-

a corporation that has a specified shareholder who is related to the beneficiary at any time in the year

-

a professional corporation that has a shareholder who is related to the beneficiary at any time in the year

-

-

for 2018 and later years, income allocated by the trust that is derived directly or indirectly from one or more related businesses

-

income allocated by the trust from the rental of property by a partnership or trust, if a person who is related to the beneficiary at any time in the year is actively engaged on a regular basis in the activity of the partnership or trust of earning that income

-

for 2018 and later years, a taxable capital gain, or a profit, allocated by the trust from the disposition of property the income of which would be "split income" of the beneficiary if they received it directly

-

deemed dividends that result from capital gains of a trust from the disposition of shares (other than shares of a class listed on a designated stock exchange or those of a mutual fund corporation) that are transferred to a person who is not at arm's length with the beneficiary

The tax on split income does not apply if:

-

the income is from property the beneficiary inherits from either:

-

a parent

-

any other individual, if the beneficiary is either enrolled as a full time student during the year, in a post-secondary educational institution or qualifies for the disability tax credit for the year

-

-

the beneficiary was a non-resident of Canada at the end of the year, or in case of a deceased beneficiary, was a non-resident of Canada immediately before death

-

neither of the beneficiary's parents lived in Canada at any time in the year

For the 2018 and later tax year, the tax on split income will also not apply in respect of taxable capital gains from the disposition of qualified farm or fishing property or qualified small business corporation shares. This does not include taxable capital gains from the disposition of certain shares to a person that does not deal at arm's length with the beneficiary.

Tax on split income for an adult beneficiary

For 2018 tax and later years, the tax on split income will also apply to individuals over the age of 17, but only with respect to certain income derived from a related business.

For more information on the application of the tax on split income to adults, including information on amounts that are excluded from an adult's split income for a tax year, and guidance on how the CRA will administer those exclusions, go to canada.ca/cra-income-sprinkling.

How to report split income

If the trust is allocating "split income" to a beneficiary, you have to inform the beneficiary that they may have to pay the special tax. Follow the instructions for completing Schedule 9 - Income Allocations and Designations to Beneficiaries on page 45 and the T3 slip on page 64. Attach a statement to the T3 slip showing the type and amount of the beneficiary's share of the split income. Advise the beneficiary in writing that they must complete Form T1206, Tax on Split Income.

Note

The attribution rules discussed in the next section

"Transfers and loans of property" do not apply to

property that is subject to split income rules.

Transfers and loans of property

Special rules may apply to amounts from a property that, under certain conditions, is held by the trust or is transferred or loaned to the trust. We refer to a person who has loaned or transferred property as the "transferor."

A transferor, who is alive and resident in Canada, may lend or transfer property to the trust for the benefit of:

-

the transferor's spouse or common-law partner, or a person who has since become the transferor's spouse or common-law partner

-

the transferor's related minor (such as a child, grandchild, sister, brother, niece, or nephew under 18 years of age at the end of the year)

In either case, any income or loss from that property may have to be reported on the transferor's return.

Note

The transferor does not have to report the income of the

trust if the related minor turns 18 years of age before the

end of the year.

The transferor may also have to report taxable capital gains or allowable capital losses from the disposition of property loaned or transferred to a trust for the benefit of the transferor's spouse or common-law partner, or a person who has since become the transferor's spouse or common-law partner.

The property may have been sold to the trust at its fair market value, or loaned to the trust at a prescribed rate of interest, which was paid within 30 days of the tax year-end. If this is the case, any income or loss, or any taxable capital gain or allowable capital loss, from that property is generally income of the trust. For this income, issue the T3 slip to the beneficiary, not to the transferor.

An individual can receive a low-interest or interest-free loan from a trust to which another individual transfers property. If the two individuals do not deal at arm's length, you will normally be required to report the income from that loaned property or any property substituted for it on the trust's return. This is not the case if the income is attributable to another individual. This also applies to an arm's length commercial loan that the individual uses to repay the original low-interest or interest-free loan.

If the trust's terms are such that the transferred property may revert to the transferor, or if the transferor keeps a certain degree of control over the property, see "Exceptions and limits to income allocations" below.

If the income from loaned or transferred property is to be included on the transferor's return, you generally have to report it on the trust's return. Issue a T3 slip reporting the income as that of the transferor.

For more information about transfers and loans of property, see Guide T4037, Capital Gains, and the following archived interpretation bulletins:

|

IT-286 |

Trusts - Amount Payable |

|

IT-369 |

Attribution of Trust Income to Settlor, and its Special Release |

|

IT-510 |

Transfers and Loans of Property Made After May 22, 1985 to a Related Minor |

|

IT-511 |

Interspousal and Certain Other Transfers and Loans of Property |

Exceptions and limits to income allocations

Generally, trust income is allocated to beneficiaries, or taxed in the trust, according to the provisions of the will or trust document, with the following exceptions and limits:

-

A post-1971 spousal or common-law partner trust (other than one created before December 21, 1991), joint spousal or common-law partner trust, or alter ego trust cannot deduct amounts payable in a tax year to anyone except one of the following:

-

for a trust that was a post-1971 spousal or common-law partner trust on December 20, 1991, or a spousal or common-law partner trust created after December 20, 1991, the beneficiary spouse or common-law partner, while the beneficiary spouse or common-law partner is alive

-

for a joint spousal or common-law partner trust, the settlor or the beneficiary spouse or common-law partner while either one of them is alive

-

for an alter ego trust, the settlor while the settlor is alive

-

-

A post-1971 spousal or common-law partner trust, joint spousal or common-law partner trust, or alter ego trust cannot deduct the allocation of any income realized from deemed dispositions of capital property, land inventory of the trust's business, and Canadian and foreign resource property that arose on the death of one of the following:

-

for a post-1971 spousal or common-law partner trust, the beneficiary spouse or common-law partner

-

for a joint spousal or common-law partner trust, the settlor or the beneficiary spouse or common-law partner, whichever is later

-

for an alter ego trust, or a trust to which property was transferred by an individual (other than a trust) where the transfer did not result in a change in beneficial ownership of that property and no person (other than the individual) has any absolute or contingent right as a beneficiary under the trust, the day on which the death of the individual occurs

-

for the deemed payment from an AgriInvest Fund 2, the beneficiary spouse or common-law partner

-

-

The trust cannot deduct income from payments out of an AgriInvest Fund 2 unless one of the following conditions are met:

-

the trust is a testamentary spousal or common-law partner trust and this income was received while the beneficiary spouse or common-law partner was alive

-

the trust is a communal organization

-

-

Under subsection 75(2) of the Act, certain inter vivos trusts resident in Canada and which were created after 1934 may have property (or property substituted for it) that:

-

may revert to the contributor

-

may be distributed to beneficiaries determined by the contributor at a time after the trust was created

-

may only be disposed of with the consent of, or at the direction of, the contributor while the contributor is alive or exists

-

Certain related amounts, including taxable capital gains and allowable capital losses from that property or the substituted property, are considered to belong to the contributor during the contributor's life or existence while a resident of Canada. The trust must still report the amount on the trust's T3 return and issue a T3 slip reporting the amount as that of the contributor of the property. For more information, see archived Interpretation Bulletin IT-369, Attribution of Trust Income to Settlor, and its Special Release.

The attribution rules in subsection 75(2) apply only in respect of property held by a trust that is factually resident in Canada. However, similar provisions exist in section 94 to apply to trusts that are deemed resident. Contact the Winnipeg Tax Centre at one of the numbers listed at page 20 for more information on how these rules apply.

-

A trust cannot allocate capital losses and non-capital losses to beneficiaries of a trust except:

-

capital losses, if it is an insurance-related segregated fund trust

-

losses of revocable trusts and from blind trusts. Report these losses in brackets in the appropriate box on a separate T3 slip for the beneficiary. Clearly indicate the type of loss in the footnote area below box 26 on the T3 slip

-

-

We consider income that was not paid or payable to a beneficiary to be allocated (as defined on page 5) to a beneficiary if they have a vested right to its income, and:

-

the trust is resident in Canada throughout the year

-

the beneficiary is under 21 years of age at the end of the year

-

the beneficiary's right to income is vested by the end of the year, it did not become vested due to the exercise or non-exercise of a discretionary power by any person, and it is not subject to any future condition other than the condition that the beneficiary survive to an age of not more than 40 years

-

-

The amount of income that can be allocated to a beneficiary may be limited if:

-

a beneficiary's share of the income of the trust is less than their capital interest in the trust

-

the beneficiary is a designated beneficiary as described on page 54 and the trust was not resident in Canada throughout the tax year

-

-

When a trust resident in Canada distributes property to a beneficiary and the trust realizes a capital gain, the trust can elect to treat the income as taxable in the trust. That is, the taxable capital gain will not be considered payable to the beneficiary if the trust:

-

was resident in Canada when it distributed the property

-

filed an election with its T3 return for the year, or a preceding tax year, in which the property was distributed

-

The election can be made for distributions to all beneficiaries or only for distributions to non-resident beneficiaries. The trust may have filed such an election in the current year or any preceding year. If this is the case, calculate the trust's income available for allocation to a beneficiary without taking into consideration any gains realized on the distribution of property to beneficiaries covered by the election while the trust was resident in Canada.

-

A deemed resident trust is limited in the amounts that it can allocate to non-resident beneficiaries. For more information, contact the Winnipeg Tax Centre at one of the numbers listed on page 20.

-

For tax years that end after March 4, 2010, a resident contributor to a deemed resident trust may elect to include in computing their income, a portion of the income earned by the trust. Generally, this portion is equal to the amount of the resident contributor's contribution to the trust as a percentage of all contributions made by all resident and connected contributors. The amount included in the electing contributor's income will be deemed to be income from property from a source in Canada, unless the amount is designated by the trust under paragraph 94(16)(c).

A valid election must be filed in writing, on or before the contributor's filing due date for the first tax year for which the election is to take effect. A valid election must also include the trust's Canadian tax account number, and proof that the contributor has notified the trust of the contributor's intention to become an electing contributor no later than 30-days after the trust's tax year that ends in the initial year. This is an irrevocable election. Once a resident contributor has chosen to become an electing contributor, they will continue to be an electing contributor for all subsequent tax years.

The trust may deduct, from its income for the tax year, an amount equal to the amount included in calculating the electing contributor's income as a result of this election. The trust must still report the amount on the trust's T3 return and issue a T3 slip reporting the amount as that of the electing contributor of the property. For more information, contact the Winnipeg Tax Centre at one of the numbers listed on page 20.

Income to be taxed in the trust ▲

You can choose to report income on the trust return, rather than report it in the hands of the beneficiaries, as long as the trust is:

-

resident in Canada throughout the year

-

not exempt from tax

-

not a specified trust (as defined in "Chart 1 - Types of Trusts" on page 9)

This applies to income paid or payable to beneficiaries.

You make this choice by indicating on line 27 of the T3 return for the year that you are making a designation under subsection 104(13.1). Once you make this choice, you cannot deduct on line 28 the income designated in the election. An example of when you might use this designation is in a year when a trust has taxable income and a non-capital loss carry forward.

Once you make the choice, you have to make it for each beneficiary. It reduces a beneficiary's income from the trust by that beneficiary's proportionate share of the income reported on the trust's return. We show you how to calculate the proportionate share in the following section.

You can make a similar designation under subsection 104(13.2) if taxable capital gains are included in the income reported on the trust's return. This will reduce the beneficiary's taxable capital gains from the trust by that beneficiary's proportionate share of taxable capital gains reported on the trust's return.

An example of when you might want to make the subsection 104(13.2) designation is when you are able to use the trust's non-capital loss or net capital loss carry forward to absorb the current-year taxable capital gain.

Generally, amounts designated under subsections 104(13.1) and 104(13.2) will reduce the adjusted cost base of a beneficiary's capital interest in the trust unless the interest was acquired for no consideration and the trust is a personal trust.

If you choose to designate any portion of the beneficiary's income to be reported on the trust return:

-

enter the amount on line 27 of the return

-

send us a statement showing the income you are designating and the amounts you are designating for each beneficiary

Designations under subsections 104(13.1) and (13.2) to retain and tax income or capital gains in the trust are restricted after 2015 as a result of subsection 104(13.3). Subsection 104(13.3) ensures that these designations are made only to the extent that the trust has a nil taxable income for the year in which the designation is made.

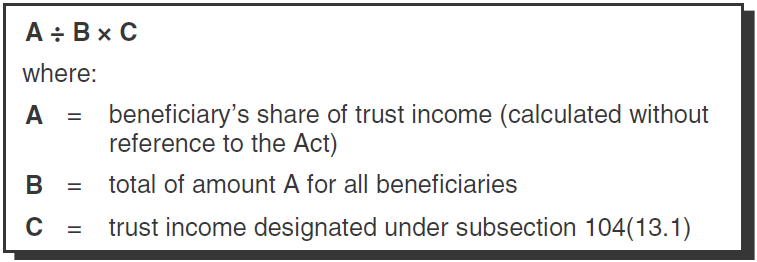

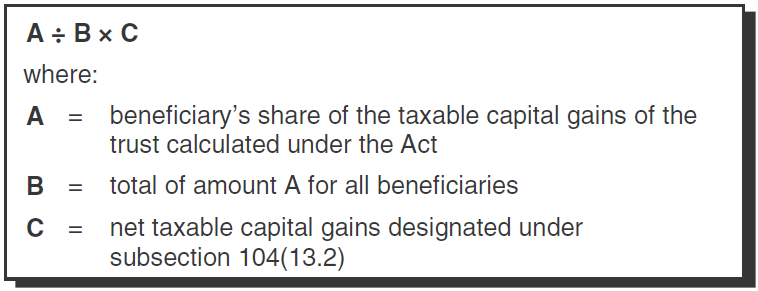

Proportionate share formulas

Use the following formulas to calculate designations under subsections 104(13.1) and 104(13.2). You have to apply these formulas to each beneficiary. A trust cannot use these designations to tax one beneficiary's share in the trust and allocate another share to a beneficiary unless the trust agreement entitles one beneficiary to the trust's income and another beneficiary to the trust's capital.

Subsection 104(13.1)

Subsection 104(13.2)

Example

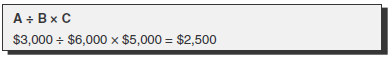

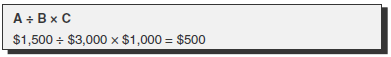

A trust's income is $9,000: investment income of $6,000 and taxable capital gains of $3,000. Both are shared equally between the trust's two beneficiaries, Josh and Ashley. The trust has $6,000 in losses from prior years to apply: a non-capital loss of $5,000 and a net capital loss of $1,000. Therefore, the trustee decides to report $6,000 of income on the trust return by designating $5,000 under subsection 104(13.1) and $1,000 of taxable capital gains under subsection 104(13.2), against which the losses are applied.

Determine the amount designated under subsection 104(13.1) for Josh as follows:

Therefore, the amount designated for Josh is $2,500. Because Ashley shares equally, her calculation is the same.

Determine the amount designated under subsection 104(13.2) for Josh as follows:

Therefore, the amount designated for Josh is $500. Because Ashley shares equally, her calculation is the same.

Preferred beneficiary election

A trust and a preferred beneficiary can jointly elect, in the year, to include in a preferred beneficiary's income for that year, all or part of the trust's accumulating income for the year. You can deduct the elected amount from the trust's income, up to the amount of the accumulating income. The elected amount for a preferred beneficiary must not be more than the allocable amount of the trust's total accumulating income. We define "Preferred beneficiary" on page 7.

The preferred beneficiary election cannot be made by the trusts listed under "Exemption from Form T1055 deemed dispositions" on page 42.

For the trusts listed below, you can only make the election for the following:

-

a spousal or common-law partner trust, in respect of the beneficiary spouse or common-law partner while the beneficiary spouse or common-law partner is alive

-

a joint spousal or common-law partner trust, in respect of the settlor or the beneficiary spouse or common-law partner while either of them is alive

-

an alter ego trust, in respect of the settlor while the settlor is still alive

A trust's accumulating income for the year is generally its income for the year after deductions, but without regard to amounts allocated under preferred beneficiary elections.

Accumulating income does not include the income from the deemed disposition of capital property, land inventory, or resource property on the death of:

-

the beneficiary spouse or common-law partner, for a spousal or common-law partner trust

-

the settlor or the beneficiary spouse or common-law partner, whichever is later, for a joint spousal or common-law partner trust

-

the settlor, for an alter ego trust

Accumulating income also does not include income arising from the deemed disposition of property to a beneficiary that results in a disposition of all or part of the beneficiary's capital interest in the trust, when the property is distributed to a beneficiary other than all of the following:

-

the beneficiary spouse or common-law partner for a post-1971 spousal or common-law partner trust if the beneficiary spouse or common-law partner is alive

-

the settlor or the beneficiary spouse or common-law partner, for a joint spousal or common-law partner trust if either of them is alive

-

the settlor, for an alter ego trust, if the settlor is alive

Accumulating income of a trust does not include amounts paid or deemed to have been paid from an AgriInvest Fund 2. However, a preferred beneficiary election can include these amounts paid to a testamentary spousal or common-law partner trust while the beneficiary spouse or common-law partner was still alive.

Note

Accumulating income is calculated as if you have

deducted the maximum amount of income that became

payable in the year to the beneficiaries.

You can make a preferred beneficiary election for a tax year by filing the following:

-

a statement making the election for the year, stating the part of the accumulating income on which you are making the election, and signed by both the preferred beneficiary (or guardian) and the trustee with the authority to make the election

-

a statement signed by the trustee showing the calculation of the amount of the beneficiary's share of the accumulating income, and indicating the beneficiary's social insurance number, their relationship to the settlor of the trust, and whether one of the following conditions is met:

-

the beneficiary is claiming a disability amount

-

a supporting individual is claiming a disability amount for that beneficiary (if yes, provide the name, address, and social insurance number of the supporting individual)

-

the beneficiary is 18 years of age or older, and in the beneficiary's tax year that ends in the trust's tax year, another individual can claim an amount for an infirm dependant age 18 or older for that beneficiary, or could claim the amount if the beneficiary's income is calculated before including the income from the preferred beneficiary election. If this is the case, provide a statement from the medical practitioner confirming the beneficiary's impairment in the first year the claim is made

-

File the election with the return or separately, no later than 90 days after the end of the trust's tax year for which the election was made. For a preferred beneficiary election to be valid, you have to file it on time. If you file the election late, we will tax the accumulating income in the trust. For more information regarding late-filed or amended elections, see "Elections" on page 22.

If you are making a preferred beneficiary election, see archived Interpretation Bulletin IT-394, Preferred Beneficiary Election.

Preferred beneficiary election and the qualified disability trust election

The introduction of the qualified disability trust (QDT) provisions has not restricted the availability of the preferred beneficiary election, nor have there been any changes to the method in which a preferred beneficiary election is made. Many of the requisite conditions for making a preferred beneficiary election differ from those required for a trust to be a QDT. Accordingly, where the respective conditions of each election are met, the trust has the ability to choose whether to make a preferred beneficiary election or a QDT election. It is also possible for a trust which elects to be a QDT to also make a preferred beneficiary election (jointly with the beneficiary) in a given tax year.

|

|

|