Form T1055, Summary of Deemed Dispositions

Form T1055, Summary of Deemed Dispositions

Form T1055, Summary of Deemed Dispositions

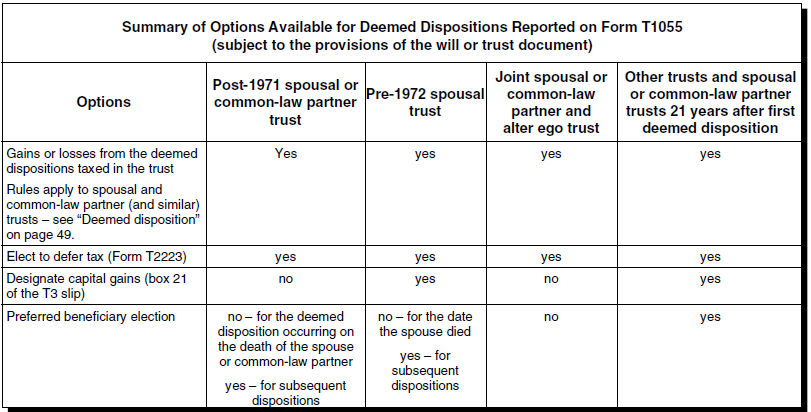

Use Form T1055 to calculate the income, or the capital gain or loss, from deemed dispositions.

Deemed disposition

A trust is deemed to have disposed of its capital property (other than exempt property), land inventory, and Canadian and foreign resource properties on specified dates called deemed disposition days. For more information about the dates, see "Deemed disposition day" on page 50.

For 2016 and subsequent years, where the primary beneficiary of an alter ego trust, spousal or common-law partner trust, or the last surviving beneficiary of a joint spousal or common-law partner trust dies, there is a deemed year-end of the trust on the date of death of the beneficiary. The income that is deemed to be recognized upon the death of the beneficiary must be reported on the trust's T3 return filed for the deemed year-end of the trust.

Note

Income of the trust which became payable to the

beneficiary prior to their death is generally included in

the amounts reported on a T3 slip to the beneficiary and

will be included in the beneficiary's income in their final

T1 return.

However, for 2016 and subsequent years, in the case of a testamentary spousal or common-law partner trust, a joint election between the trust and the deceased beneficiary's graduated rate estate can be filed to report the income that is deemed to be recognized upon the death of the beneficiary for the year in the beneficiary's final T1 return. This income shall be reported on the T3 slip issued to the beneficiary. For the joint election to be valid all the following requirements must be met:

-

Immediately before death, the beneficiary was a resident of Canada.

-

The trust is a testamentary trust that is a post-1971 spousal or common-law partner trust and was created by the will of a taxpayer who died before 2017.

-

A copy of the joint election is filed with both the final T1 return of the beneficiary and the T3 return for the deemed year-end of the trust. To make the election, send us a letter for both the final T1 return and the trust's T3 return with all of the following information:

-

the T1 and T3 account numbers

-

the income amount that was allocated in the T3 slip and reported on the final T1 return filed for the deceased beneficiary

-

the signatures, names and addresses of both the trustee(s) of the trust and the executor(s) for the deceased beneficiary

-

The due date for both the T3 return as well as any balance payable of the deemed taxation year will be 90 days after the end of the calendar year in which the deemed year-end falls. For example, should the deemed year-end fall on June 3, the return and any balance payable will be due 90 days after December 31.

In addition to the properties referred to above, if a post-1971 testamentary spousal or common-law partner trust holds an AgriInvest Fund 2 that was transferred to it on the death of the settlor, report a deemed payment out of the fund on the day the beneficiary spouse or common-law partner dies.

If, after a deemed disposition that was to be reported on Form T1055, the trust actually disposed of the property in the same tax year, use Schedule 1 to report the gain or loss from the actual disposition. If the trust is a post-1971 spousal or common-law partner trust, a joint spousal or common-law partner trust, or an alter ego trust, the gain or loss should instead be reported on Form T1055.

If a deemed disposition occurs, the trust is considered to have done both of the following:

-

disposed of its capital property (including depreciable property of a prescribed class), land inventory, and Canadian and foreign resource properties at the end of the deemed disposition day, at the fair market value (FMV)

-

reacquired them immediately after, at a cost equal to the same FMV

For depreciable property, the trust has to report both capital gains and recapture of capital cost allowance.

Use Form T1055 to calculate:

-

the adjustments to line 24 of Schedule 1

-

the amount of tax on which the trust can elect to defer payment

-

the amount of taxable and deemed taxable capital gains to which you can apply the trust's net capital losses of other years

Deemed disposition day

This is the day we consider the trust to have disposed of its capital property, land inventory, and Canadian and foreign resource properties.

Generally, it is one of the following:

-

For a spousal or common-law partner trust, the day the beneficiary spouse or common-law partner died.

-

For a joint spousal or common-law partner trust, the day the settlor or the beneficiary spouse or common-law partner died, whichever is later.

-

For an alter ego trust, the day the settlor died, unless the trust filed an election not to be considered an alter ego trust (see the definition of alter ego trust in "Chart 1 - Types of Trusts"on page 10. If the trust has filed an election, the deemed disposition date will be 21 years after the day the trust was created.

-

For a trust to which property was transferred by an individual (other than a trust) where the transfer did not result in a change in beneficial ownership of that property and no person (other than the individual) or partnership has any absolute or contingent right as a beneficiary under the trust, on the day the individual dies.

-

For other trusts, 21 years after the day the trust was created.

Subsequent deemed dispositions will occur every 21 years, on the anniversary of the day established above.

The following deemed disposition days will not result in another deemed disposition on the 21st anniversary of that deemed disposition day. Instead, the next deemed disposition for such trusts will occur 21 years after the day the trust was created or on the anniversary of a deemed disposition day otherwise established:

-

Where a trust distributes property after December 17, 1999, to a beneficiary in respect of the beneficiary's capital interest in the trust and it is reasonable to consider that the distribution was financed by a liability of the trust, and one of the reasons for incurring the liability was to avoid paying taxes because of the death of any individual, the day the property was distributed.

-

Where an individual has transferred property (other than real property situated in Canada, Canadian resource property, or a timber resource property, property of a business carried on by the trust through a permanent establishment in Canada including capital property, property included in Class 14.1 (eligible capital property before January 1, 2017) in respect of or, and property described in the inventory of the business, or certain pension or other similar rights or interests) after December 17, 1999, to a trust for the transferor's spouse or common-law partner, and it is reasonable to conclude that the property was transferred knowing that the individual planned to emigrate from Canada, the day the individual ceases to be resident in Canada.

Exemption from Form T1055 deemed dispositions

When a trust is excluded from the deemed disposition rule in paragraph 104(4)(b) (for example, all of the trust's interests had vested indefeasibly prior to the 21st anniversary after the day the trust was created), or is not reporting any deemed dispositions, a statement should be sent to us outlining the reason(s) for not filing Form T1055.

The following trusts are excluded from the deemed dispositions reported on Form T1055:

-

A specified trust (as described in "Chart 1 - Types of Trusts"on page 17)

-

A unit trust

-

A trust in which all interests have been permanently vested. This exception applies primarily to those commercial trusts (all trusts other than personal trusts) that do not qualify as unit trusts. This exception does not apply to any of the following:

-

a post 1971 spousal or common-law partner trust

-

a joint spousal or common-law partner trust or an alter ego trust

-

a trust to which property was transferred by an individual (other than a trust) where the transfer did not result in a change in beneficial ownership of that property and no person (other than the individual) or partnership has any absolute or contingent right as a beneficiary under the trust

-

a trust resident in Canada that has non-resident beneficiaries, if the fair market value (FMV) of the non-resident beneficiaries' interests in the trust is more than 20% of the total FMV of all the interests in the trust

-

a trust that distributed property after December 17, 1999, to a beneficiary in respect of the beneficiary's capital interest in the trust and it is reasonable to consider that the distribution was financed by a liability of the trust, and one of the reasons for incurring the liability was to avoid paying taxes because of the death of any individual

-

a trust under the terms of which, all or part of any person's interest is to be terminated with reference to a period of time otherwise than as a consequence of terms of the trust under which an interest in the trust is to be terminated as a result of a distribution to the person (or the person's estate) of property of the trust if the FMV of the property to be distributed is proportionate with the FMV of the person's interest immediately before the distribution

-

|

|

|