663 Capital cost allowance

663 Capital cost allowance

An accelerated investment incentive was introduced to enable a trust to obtain an increased additional deduction with respect to property acquired for the taxation year in which the property becomes available for use. Some property acquired after December 3, 2018, can thus benefit from a permanent additional CCA of 30%.

Property acquired after December 3, 2018, that is qualified intellectual property or general-purpose electronic data processing equipment can, under certain conditions, give entitlement to an accelerated CCA corresponding to the full acquisition cost in the year it became available for use.

Accelerated CCA for qualified intellectual property or general-purpose electronic data processing equipment

A trust can deduct the full acquisition cost of property that is qualified intellectual property or general-purpose electronic data processing equipment for the taxation year in which the property became available for use.

The term "qualified intellectual property" means property acquired after December 3, 2018, that is a patent or a right to use patented information, a licence, a permit, know-how, a commercial secret or other similar property constituting knowledge and that is property included in class 14 of Schedule B to the Regulation respecting the Taxation Act, property included in class 44 of that schedule or property that is incorporeal capital property.

To be qualified intellectual property the property must:

-

be acquired by the trust in the course of a technology transfer or developed by or on behalf of the trust with a view to enabling it to implement an innovation or invention concerning its business;

-

be used within a reasonable time after being acquired or after its development is completed;

-

be used only in Québec and primarily in the course of carrying on a business for the period covering the process of implementing the innovation or invention.

General-purpose electronic data processing equipment is property included in class 50 of Schedule B to the Regulation respecting the Taxation Act. To qualify for accelerated CCA, it must be used primarily in Québec in the course of carrying on a business, and put into use before 2024.

Property that is not considered qualified intellectual property or that is computer equipment that is AIIP, but that does not meet the above requirements, can qualify for the CCA rules applicable to such property.

Introduction of an additional CCA of 30%

Some property can benefit from a permanent additional CCA of 30%. Consequently, a trust can deduct from its business income for a taxation year an amount corresponding to 30% of the CCA deducted from its income for the previous taxation year with respect to the following property, if the trust acquired the property after December 3, 2018:

-

machinery or equipment used in manufacturing or processing, namely property included in class 53 of Schedule B to the Regulation respecting the Taxation Act;

-

clean energy generation equipment, namely property included in class 43.1 of the schedule or property included in class 43.2 of the schedule;

-

general-purpose electronic data processing equipment and systems software for that equipment, namely property included in class 50 of the schedule, other than property that had allowed or could have allowed the taxpayer to claim the additional capital cost allowance of 60%, provided the property is:

-

new at the time of its acquisition,

-

used within a reasonable time after its acquisition,

-

used primarily in Québec in the course of carrying on a business for a period of at least 730 consecutive days after the property's use began;

-

-

qualified intellectual property.

For more information on rates and deductions for other classes of depreciable property, refer to guide IN-155-V, Business and Professional Income.

Instructions for completing the capital cost allowance table

The instructions below can be used to complete both Schedule F and form TP-128. F-V, Income Earned by a Trust from the Rental of Immovable Property.

Cost of acquisitions and additions made during the taxation year (column 3)

Enter the cost of acquisitions and additions made to the specified immovable during the taxation year concerned. If property was transferred to the trust by way of an inter vivos gift, enter the FMV of the property at the time of transfer.

In the case of property held in co-ownership, enter the amount that corresponds to the trust's percentage interest in the immovable.

Cost of acquisitions in column 3 that are accelerated investment incentive property (AIIP) (column 3.1)

Use column 3.1 only for AIIP acquired after November 20, 2018, that became available for use during the taxation year.

Amount respecting dispositions made during the taxation year (column 4)

For each property of a prescribed class that was disposed of in the taxation year, determine the lesser of the following two amounts:

-

the proceeds of disposition of the property (after subtracting the expenses incurred for the disposition);

-

the capital cost of the property.

In the case of property held in co-ownership, enter the amount that corresponds to the trust's percentage interest in the immovable.

Do the same calculation for all the property of a prescribed class that was disposed of. Add the amounts determined and enter the result in column 4.

Refer to section 5.1.1 for information about the rules that apply to the transfer of property by a personal trust to its beneficiaries.

UCC before a reduction for new property (column 5)

A negative result entered in column 5 corresponds to a recapture of capital cost allowance. If one or more immovables remain in the class at the end of the taxation year, enter "0" in column 10.

A positive result corresponds to a terminal loss if there are no immovables remaining in the class at the end of the taxation year.

Proceeds of dispositions that can reduce the capital cost of AIIP acquired in the taxation year (column 5.1)

Use column 5.1 only for AIIP acquired after November 20, 2018, that became available for use during the taxation year.

UCC adjustment based on AIIP acquired in the taxation year (column 5.2)|

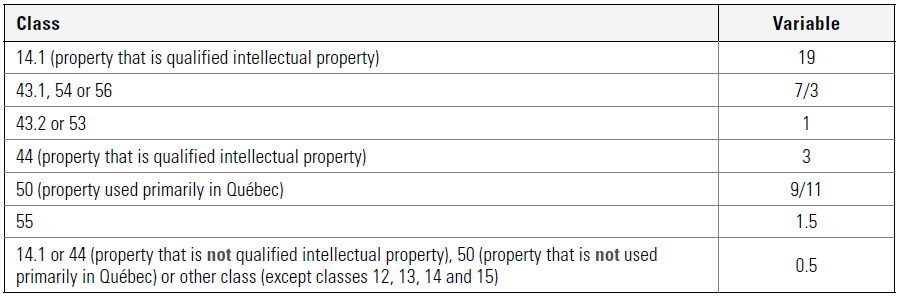

Use column 5.2 only for AIIP acquired after November 20, 2018, that became available for use during the taxation year. Refer to the table below for the variable to be used to calculate the amount in column 5.2 for AIIP available for use before 2024.

Note that the straight-line depreciation method is used for property in classes 12, 13, 14 and 15. For those classes, enter the amount of CCA you are claiming directly in column 9.

Reduction (column 6)

Do not make adjustments in column 6 for property acquired from a person with whom the trust was not dealing at arm's length, if the property was depreciable property of the person continuously for at least 364 days immediately before the trust acquired it.

Take into account, in the calculation of the reduction, the amount from column 3.1 for AIIP acquired after November 20, 2018, that became available for use during the taxation year.

Base amount for CCA calculation (column 7)

For column 7, take into account the amount from column 5.2 only for AIIP acquired after November 20, 2018, that became available for use during the taxation year.

Capital cost allowance (column 9)

Enter in column 9 the amount of capital cost allowance that the trust is deducting. The amount cannot be greater than the result that is obtained when the amount in column 7 is multiplied by the rate in column 8.

For more information about AIIP, refer to the guide entitled Business and Professional Income (IN-155-V).

|

|

|