Line 367 - Amount for dependants and amount transferred by a child 18 or over enrolled in post-secondary studies

Line 367 - Amount for dependants and amount transferred by a child 18 or over enrolled in post-secondary studies

Line 367 - Amount for dependants and amount transferred by a child 18 or over enrolled in post-secondary studies

Child under 18 enrolled in post-secondary studies (Part A of Schedule A)

You can enter an amount for post-secondary studies for a child who was born after December 31, 2006, if in 2024 the child was your dependant and was a full-time student pursuing vocational training at the secondary level or post-secondary studies. You can claim $3,717 for each completed term that the child began in 2024, up to a maximum of two terms per child. The amount that you can claim is shown on the RL-8 slip issued to the child by the educational institution they attended in 2024.

To calculate the amount you can claim, complete Part A of Schedule A.

Child under 18 who had a spouse

You cannot claim an amount for a child under 18 enrolled in post-secondary studies if the child had a spouse on December 31, 2024 (see the definition at line 12), and the spouse is claiming an amount for credits transferred from one spouse to the other on line 431 of their return.

Educational institution located outside Québec

If the educational institution is located outside Québec, contact us for a blank RL-8 slip and then have the registrar at the institution complete it. Keep the slip in case we ask for it.

Child's income

The child's net income for the year is calculated without including any scholarships, bursaries, fellowships or prizes for achievement they received, or the deduction for residents of designated remote areas.

If, for all or part of the year, the child was not resident in Canada, you must take into account all of the child's income, including income earned while not resident in Canada.

Child under 18 enrolled in post-secondary studies

A person born after December 31, 2006, who, in 2024, was your dependant and was a full-time student pursuing vocational training at the secondary level or post-secondary studies.

|

NOTE The person can be:

|

Splitting the amount for a child under 18 enrolled in post-secondary studies

If someone else also contributed to the support of a child under 18 who was a full-time student pursuing vocational training at the secondary level or post-secondary studies, you may have to split the amount claimed regarding the child on line 21 of Schedule A with that person. If that is the case, multiply the amount on line 21 by the percentage that you and the other person agree on. The total percentage must not be more than 100%.

Amount transferred by a child 18 or over enrolled in post-secondary studies (Part B of Schedule A)

If you are the father or mother of a child who was born before January 1, 2007, your child can transfer an amount to you representing the recognized parental contribution, provided they:

-

were a full-time student enrolled in vocational training at the secondary level or in post-secondary studies; and

-

completed at least one term that they began in 2024.

Father or mother

A person who:

-

has a bond of filiation with the child (that is, the person is the father or mother named on the child's certificate of birth);

-

is the spouse of the child's father or mother;

-

is the father or mother of the child's spouse; or

-

had custody of the child, supervised the child, and fully supported the child immediately before their 19th birthday.

Claiming the amount

The child must complete Schedule S to calculate the amount that can be transferred and designate the recipient(s) of the transfer. Schedule S must be enclosed with the child's return. The child can divide the transferred amount between their father and mother.

If the child is transferring an amount to you, you must complete Part B of Schedule A. Enter the transferred amount on line 28.

Child 18 or over enrolled in post-secondary studies who does not transfer an amount

If the child can transfer an amount to you but does not do so, you may be able to claim an amount for other dependants in Part C of Schedule A (see below).

Educational institution located outside Québec

If the educational institution is located outside Québec, contact us for a blank RL-8 slip and then have the registrar at the institution complete it. Keep the slip in case we ask for it.

Child 18 or over not enrolled in post-secondary studies on a full-time basis

If a child born before January 1, 2007, was your dependant in 2024 but was not a full-time student pursuing vocational training at the secondary level or post-secondary studies, you may be able to claim an amount for other dependants in Part C of Schedule A (see below).

Other dependants (Part C of Schedule A)

Under certain conditions, you can claim an amount for other dependants on line 367.

Other dependant

A person who meets all three of the following conditions:

-

The person was born before January 1, 2007.

-

The person is related to you by blood, marriage or adoption.

-

In 2024, the person ordinarily lived with you and was supported by you.

The person cannot be:

-

your spouse;

-

a child who, in 2024, is transferring an amount as a child 18 or over enrolled in post-secondary studies (lines 20.1 and 20.2 of Schedule S); or

-

a person whose spouse is deducting, on line 431 of their return, an amount for credits transferred from one spouse to the other.

|

NOTE The person can be:

|

Basic amount

The basic amount is $5,416 for each of your other dependants.

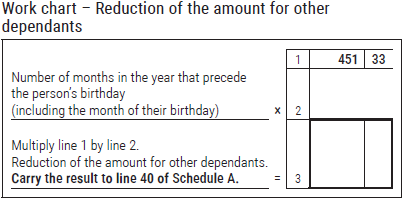

Reduction of the amount for other dependants

If you are claiming an amount for a person who turned 18 in 2024, complete the work chart on the next page.

Other dependant's income

The dependant's net income for the year is calculated without including any scholarships, bursaries, fellowships or prizes for achievement they received, or the deduction for residents of designated remote areas.

If, for all or part of the year, the dependant was not resident in Canada, you must take into account all of the dependant's income, including income earned while not resident in Canada.

Splitting the amount for other dependants

If someone else also contributed to the support of your dependant, you may have to split the amount that can be claimed on line 54 of Schedule A with that person. If that is the case, multiply the amount on line 54 by the percentage that you and the other person agree on. The total percentage must not be more than 100%.

New resident of Canada in 2024

If the person for whom you are entering an amount for other dependants was not resident in Canada, you must provide a document attesting that they were your dependant and that you supported them (for example, proof of your payments).

|

|

|