Line 376 - Amount for a severe and prolonged impairment in mental or physical functions

Line 376 - Amount for a severe and prolonged impairment in mental or physical functions

Line 376 - Amount for a severe and prolonged impairment in mental or physical functions

Enter $4,009 if you were 18 or older and had a severe and prolonged impairment in mental or physical functions in 2024.The impairment must be certified by a physician, a specialized nurse practitioner, an optometrist, an audiologist, a speech-language pathologist (speech therapist), an occupational therapist, a psychologist or a physiotherapist, as applicable.

Your impairment is considered severe and prolonged if it has lasted (or is expected to last) for at least 12 consecutive months and either of the following situations applies to you:

Even with therapy, the appropriate devices or medication, you are always or almost always:

-

unable to perform one of the following basic activities of daily living without it taking an inordinate amount of time: seeing, speaking, hearing, walking, eliminating, feeding or dressing yourself, or functioning in everyday life because you do not have the necessary mental functions (remunerated work, social activities, recreational activities or housekeeping are not basic activities of daily living); or

-

restricted in more than one of the above-mentioned activities, if the cumulative effect of the restrictions is equivalent to having a single marked restriction in one of those activities.

Because of a chronic disease, you undergo therapy prescribed by a physician or specialized nurse practitioner at least twice a week, and the therapy:

-

is essential to the maintenance of one of your vital functions; and

-

requires at least 14 hours per week (including time for travel, medical appointments and post-treatment recovery).

Effective 2021, treatments for type 1 diabetes meet the criteria for essential therapeutic treatments.

If your health has improved since you last filed a document certifying the impairment, you must inform us.

Form to enclose

Enclose form TP-752.0.14-V, Certificate Respecting an Impairment, or Canada Revenue Agency form T2201, Disability Tax Credit Certificate, with your return. However, you must file form TP-752.0.14-V if you are in situation 2 above.

|

NOTE If someone claims the tax credit for caregivers with respect to you, they must submit form TP-752.0.14-V instead of form T2201 to confirm that you cannot live alone or need assistance in carrying out a basic activity of daily living due to a severe and prolonged impairment in mental or physical functions.See the instructions for point 2 of line 462. |

Reduction of the amount for a severe and prolonged impairment in mental or physical functions

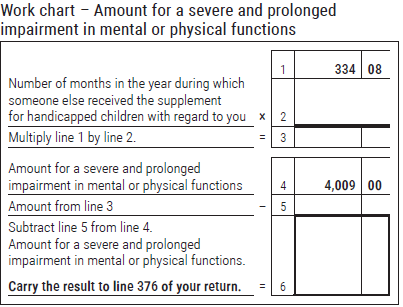

The impairment amount is reduced if, at some point in 2024, a person received, with regard to you, the supplement for handicapped children (included in the Family Allowance from Retraite Québec). To determine the amount to which you are entitled, use the work chart below.

Remuneration paid to a full-time attendant or fees paid for full-time residence in a nursing home

You cannot claim the impairment amount on line 376 if the remuneration paid to a full-time attendant is used to calculate a tax credit for medical expenses in your or someone else's income tax return, unless the amount claimed as remuneration paid to the attendant is $10,000 or less (see "Remuneration paid to an attendant" in the instructions for line 381).

Similarly, you cannot claim the impairment amount on line 376 if the fees paid for your full-time residence in a nursing home have already been used to calculate a tax credit for medical expenses in your or someone else's income tax return, unless:

-

a receipt issued by the nursing home specifically shows an amount for the remuneration paid to a full-time attendant;

-

the amount for the remuneration paid to a full-time attendant is $10,000 or less; and

-

only the portion of the residence fees specifically relating to the remuneration of the attendant is included in the medical expenses.

For more information, see brochure IN-132-V, Taxation and Persons with Disabilities.

|

|

|