Line 456 - Tax credits respecting the work premium

Line 456 - Tax credits respecting the work premium

Line 456 - Tax credits respecting the work premium

Basic requirements

To claim any of the refundable tax credits respecting the work premium (work premium, adapted work premium or supplement to the work premium [for former recipients of last-resort financial assistance or financial assistance under the Aim for Employment Program]), you must meet all of the following requirements:

-

You were resident in Québec on December 31, 2024, and are a Canadian citizen, an Indian registered as such under the Indian Act, a permanent resident within the meaning of the Immigration and Refugee Protection Act or a person on whom Canada has conferred refugee protection under that Act.

-

You were born before January 1, 2007 (or you were born after December 31, 2006, and one of the following applies to your situation: you had a spouse on December 31; you were the father or mother of a child who lived with you; or you were recognized as an emancipated minor by a competent authority such as a court).

-

You or your spouse on December 31, if applicable, is reporting employment income, a research grant, Wage Earner Protection Program (WEPP) payments or income from a business that was carried on by you and/or your spouse, either independently or as a partner actively engaged in the business.

-

You are not transferring an amount as a child 18 or over enrolled in post-secondary studies to your father or mother (lines 20.1 and 20.2 of Schedule S).

-

No one received the Family Allowance from Retraite Québec with regard to you, unless you turned 18 before December 1, 2024.

-

No one designated you as a dependent child for purposes of the work premium or the adapted work premium (line 50 of Schedule P).

-

You were not a full-time student (if you were a full-time student, you are not entitled to the tax credits respecting the work premium unless, on December 31, 2024, you were the mother or father of a child who lived with you).

You cannot claim any of the tax credits respecting the work premium if you were confined to a prison or similar institution on December 31, 2024, and you were confined for more than 183 days in 2024.

Spouse on December 31 (for purposes of the tax credits respecting the work premium)

A spouse on December 31, 2024 (see the definition at line 12), who, at the end of that day:

-

was resident in Québec; and

-

was not confined to a prison or similar institution (or was confined to such an institution for fewer than 184 days in 2024).

Full-time student

A person who began a term of vocational training at the secondary level or post-secondary studies during the year, devoted at least nine hours per week to attending classes or completing assignments in the course of the program in which they were enrolled, and completed the term in question.

|

NOTE If the person has a major functional deficiency within the meaning of the Regulation respecting financial assistance for education expenses, they must receive, as part of the program, at least 20 hours of instruction per month. |

Claiming the credits

You can now receive the work premium tax credits without completing Schedule P. However, completing it is the only way to make sure that you receive the full amount you are entitled to.

Advance payments of the tax credits respecting the work premium

If, in 2024, you received advance payments of any of the tax credits respecting the work premium (work premium, adapted work premium or supplement to the work premium [for former recipients of last-resort financial assistance or financial assistance under the Aim for Employment Program]), enter on line 441 the amount from box A (and, if applicable, the amount from box B) of your RL-19 slip.

Designated dependent child

For purposes of the work premium and adapted work premium, you can designate your child or that of your spouse on December 31 as a dependent child if they are:

-

a child for whom you or your spouse on December 31 received the Family Allowance payment from Retraite Québec for the last month of 2024;

-

a child who was born after December 31, 2006, who was a full-time student pursuing vocational training at the secondary level or post-secondary studies in 2024, and for whom you or your spouse is claiming (or could have claimed, had the child not earned income) an amount for a child under 18 enrolled in post-secondary studies (line 21 of Schedule A);

-

a child who was born before January 1, 2007, and who, in 2024, was a full-time student pursuing vocational training at the secondary level or post-secondary studies for which they received an RL-8 slip with an amount in box A; or

-

a child who had not yet turned 18 at the end of 2024, who ordinarily lived with you, who does not have a child of their own whom they live with, and who is not recognized as an emancipated minor by a competent authority such as a court. If custody of the child is shared under a judgment or written agreement, the child is deemed to have ordinarily lived with you only if, for the last month of the year, you or your spouse had custody at least 40% of the time.

You cannot designate as a dependent child a person who was confined to a prison or a similar institution on December 31, 2024, if they were confined for more than 183 days in 2024.

Your designated dependent child cannot claim any of the tax credits respecting the work premium for the year.

You or your spouse was not resident in Canada throughout the year

If, for all or part of 2024, you or your spouse on December 31 (see the definition on the previous page) was not resident in Canada, you must take into account, in determining your family income, all of the income that you and your spouse earned, including income earned while you or your spouse was not resident in Canada.

Supplement to the work premium (for former recipients of last-resort financial assistance or financial assistance under the Aim for Employment Program)

Additional requirements

You may be entitled to a supplement of $200 per month if all of the following requirements are met:

-

The month in question is included in a period of transition to work.

-

For at least 24 of the 30 months immediately preceding your period of transition to work, you received last-resort financial assistance or financial assistance under the Aim for Employment Program.

-

Your employment income (plus, if applicable, the net income from a business that you carried on alone or as a partner actively engaged in the business) is at least $200 for the month.

-

For the first month of your period of transition to work, you held a valid claim slip issued by the Ministère de l'Emploi et de la Solidarité sociale providing access to dental and pharmaceutical services.

Period of transition to work

A period:

-

beginning on the first day of the month in which you stop receiving, because of work income earned by you or your spouse at the time:

-

last-resort financial assistance, or

-

financial assistance under the Aim for Employment Program; and

-

-

ending no later than:

-

the last day of the eleventh month following that month, or

-

the last day of the month preceding the one for which you become eligible for the same financial assistance again.

-

To claim the supplement to the work premium (for former recipients of last-resort financial assistance or financial assistance under the Aim for Employment Program), complete parts D and F of Schedule P.

If you and your spouse on December 31 both received RL-5 slips with a number of months in box V, you must each complete your own Schedule P and enclose it with your respective returns.

Work premium

You are not entitled to the work premium if either of the following statements applies to your situation:

-

You had a spouse on December 31 (see the definition on the previous page) and your work income (total of lines 29 and 49 of Schedule P) is $3,600 or less.

-

You did not have a spouse on December 31 and your work income (line 29 of Schedule P) is $2,400 or less.

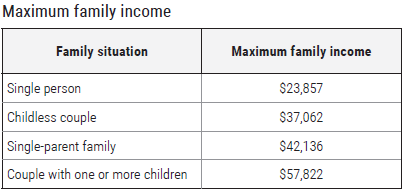

If your work income is greater than the applicable amount above, use the table below to determine the maximum family income for your family situation. If your family income is equal to or greater than the maximum family income, you are not entitled to the work premium. If it is less than the maximum, complete column 1 in Part E of Schedule P.

Adapted work premium

Additional requirements

You can claim the adapted work premium if you or, if applicable, your spouse on December 31 (see the definition on the previous page)

-

received, in 2024 or in one of the preceding five years, an allowance under the Social Solidarity Program or benefits under the Basic Income Program because of a severely limited capacity for employment; or

-

was entitled, in 2024, to the amount for a severe and prolonged impairment in mental or physical functions (see the instructions for line 376).

If you are eligible for the adapted work premium, you can claim either the work premium or the adapted work premium, whichever is greater.

You are not entitled to the adapted work premium if your work income (line 29 if you did not have a spouse on December 31, or the total of lines 29 and 49 if you did) is $1,200 or less.

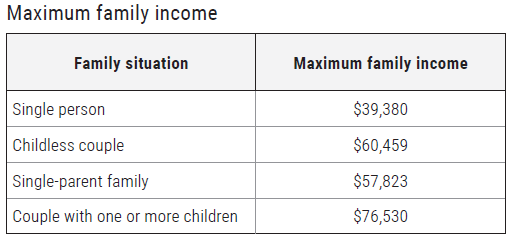

If your work income is over $1,200, use the table below to determine the maximum family income for your family situation. If your family income is equal to or greater than the maximum, you are not entitled to the adapted work premium. If it is less than the maximum, complete column 2 in Part E of Schedule P.

Splitting the work premium or the adapted work premium

You and your spouse on December 31, 2024, can split the work premium or the adapted work premium. To do so, you must each complete your own Schedule P.

If you or your spouse on December 31, 2024, received advance payments of the work premium, the person who received them should claim the work premium in their income tax return.

|

|

|