Line 458 - Tax credit for home-support services for seniors

Line 458 - Tax credit for home-support services for seniors

Line 458 - Tax credit for home-support services for seniors

Eligibility

You may be entitled to a refundable tax credit for expenses related to home-support services if you meet both of the following conditions:

-

You were resident in Québec on December 31, 2024.

-

You were at least 70 years of age on December 31, 2024.

If you turned 70 in 2024, you can claim the tax credit only for expenses paid in the year for home-support services that were rendered or that will be rendered on or after your 70th birthday.

If you had a spouse on December 31, 2024 (see the definition at line 12), and you are both entitled to the tax credit, only one of you can claim the credit for your couple. Regardless of who is claiming it, the amount for your couple will be the same. However, if either of you received advance payments of the tax credit, the person who received them should claim the credit. See "Claiming the tax credit" on the next page.

Amount of the tax credit

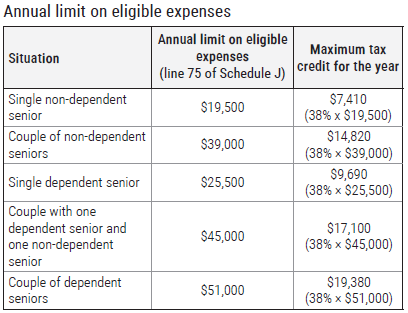

The tax credit is equal to 38% of your eligible expenses. The annual expense limit varies depending on whether you are a dependent senior or a non-dependent senior. See the table below for the maximum you can enter on line 75 of Schedule J.

Dependent senior

A person in either of the following situations:

-

They need constant help with most of their needs and personal care (washing, dressing and feeding themselves, and moving around inside the home).

-

They need constant supervision because of a severe and permanent mental disorder affecting thought activity (for example, Alzheimer's disease or dementia).

|

NOTE To confirm that you are a dependent senior, you must provide a written certificate from a physician or specialized nurse practitioner. You can use form TPZ-1029.MD.A-V, Certification of Dependent Senior Status: Tax Credit for Home-Support Services for Seniors. |

Reduction of the tax credit based on family income

The tax credit will be reduced if your family income is over $69,040. The reduction varies depending on your situation. For more information about the reduction, see our website or brochure IN-151-V, Overview of the Tax Credit for Home-Support Services for Seniors.

Your family income is the amount on line 275 of your return. If you had a spouse on December 31, 2024 (see the definition at line 12), your family income is the amount on line 275 of your return plus the amount on line 275 of your spouse's return.

If you or your spouse was not resident in Canada for all or part of 2024, you must calculate your family income (Part B of Schedule J) by taking into account all the income you and your spouse earned in the year, including any income earned while not resident in Canada.

Claiming the tax credit

You must complete Schedule J to claim the tax credit. If there is an amount in box E of your RL-19 slip, also see the instructions for line 466.

You lived in a private seniors' residence in 2024

If you lived in a private seniors' residence in 2024, complete section 1 of Part A of Schedule J.

Private seniors' residence

A facility that is either:

-

a congregate residential facility, or any part of such a facility, in respect of which the operator holds:

-

a temporary or regular authorization for the operation of a private seniors' residence granted under the Act to make the health and social services system more effective; or

-

a temporary certificate of compliance or a certificate of compliance for the operation of a private seniors' residence issued under the Act respecting health services and social services for the Inuit and Naskapi or the Act respecting health services and social services.

-

-

a private residential and long-term care centre (CHSLD) that is not under agreement.

You lived in an apartment building (other than a private seniors' residence) in 2024

If you lived in an apartment building (other than a private seniors' residence) in 2024, complete section 2 of Part A of Schedule J.

In such a case, 5% of your monthly rent is eligible for the tax credit. The minimum eligible rent is $600. If your monthly rent is less than that, you must calculate the credit as if your rent were $600. Likewise, the maximum eligible rent is $1,200, which means that if your monthly rent is more than that, you must calculate the credit as if your rent were $1,200.

If you are eligible for the tax credit and we have all the required information on file, you can get a tax credit calculated using the $600 minimum rent automatically without completing Schedule J. However, if your rent is over $600, it is to your advantage to complete section 2 of Part A to ensure that you get the full amount you are entitled to.

Line 30 of Schedule J

In column 1, enter your rent for the first month you lived in your apartment in 2024 (maximum $1,200). If your rent was less than $600, enter $600. If your rent was more than $1,200, enter $1,200.

Only enter an amount in column 2 if it is different from the amount in column 1.

|

NOTE If you or your spouse received (or is entitled to receive) a reimbursement of a portion of your rent, the reimbursement reduces the amount of rent that you can enter on line 30. However, financial assistance received in a form other than a reimbursement and the use of which you are not required to account for (such as the shelter allowance) does not reduce the amount of rent that you can enter in column 1. |

If you lived with one or more co-tenants and none of them was your spouse, divide the total monthly rent (minimum $600 and maximum $1,200) by the total number of people living in the apartment to get your share of the rent to enter in column 1.

If you lived with your spouse and one or more other co-tenants, contact us.

Special case

If your monthly rent was between $600 and $1,200 and changed more than once in the year, do the calculations on lines 30 through 33 for each month your rent changed. Then, add up the results and enter the total on line 34 of Schedule J.

You lived in a condominium in 2024

If you lived in a condominium you owned in 2024, your condominium fees (also called "common expenses") may have included the cost of eligible services.

Complete section 3 of Part A of Schedule J.

On line 36, enter the total paid in the year for eligible services included in your condominium fees. This amount is shown on line 19 of the Information Return: Tax Credit for Home-Support Services for Seniors (form TPZ-1029.MD.5-V) that your syndicate of co-owners gave you.

|

NOTE If you were a tenant in a condominium, see "You lived in an apartment building (other than a private seniors' residence) in 2024" opposite. |

You lived in your own house or you paid for services not included in your rent or condominium fees

Complete lines 50 through 74 of Schedule J if either of the following applied to your situation in 2024:

-

You paid for eligible home-support services and you lived in your own house.

-

You paid for eligible home-support services that were not included in your rent or condominium fees.

|

NOTE

|

Housekeeping, grounds maintenance and snow removal services (line 50 of Schedule J)

Housekeeping services include:

-

sweeping, dusting and cleaning living areas;

-

maintaining appliances (cleaning an oven or a refrigerator);

-

cleaning rugs and upholstered furniture (sofas and armchairs);

-

cleaning air ducts (if they do not have to be dismantled); and

-

chimney sweeping.

|

NOTE

|

Grounds maintenance services include:

-

lawn care (fertilization and mowing);

-

pool maintenance;

-

hedge trimming and plant-bed maintenance;

-

tree pruning; and

-

raking leaves.

|

NOTE Grounds maintenance work does not include the cost of maintenance products or any other property used in such work. |

Personal care services and meal preparation and delivery services (line 52 of Schedule J)

Personal care services are related to daily activities that a person is unable to perform on their own because of their health. They include services related only to:

-

dressing;

-

personal hygiene (for example, help with bathing);

-

personal mobility and transfers (moving around inside the home); and

-

eating and drinking.

Meal preparation and delivery services include:

-

meal preparation and delivery by a non-profit community organization such as Meals on Wheels; and

-

help preparing meals in your dwelling.

|

NOTE

|

Nursing services (line 54 of Schedule J)

Nursing services include the care provided by:

-

a nurse; or

-

a nursing assistant.

|

NOTE To qualify for the tax credit for home-support services for seniors, nursing services must not be included in the amount for medical expenses (line 381). |

Other eligible services (line 56 of Schedule J)

Other eligible services include:

-

supervision and support services;

-

civic support services;

-

laundry services;

-

supplying everyday necessities; and

-

minor maintenance work outside the dwelling (such as installing and removing a portable shelter).

Supervision and support services include:

-

non-specialized night supervision, monitoring and companion sitting;

-

person-centred remote monitoring services (such as emergency call systems activated by a panic button on a bracelet or pendant, or a remote health monitoring system that reads vital signs [pulse, blood pressure, blood oxygen saturation levels, etc.] and blood glucose levels);

-

services related to the use of a personal GPS locator (while the cost of renting or purchasing such a device is not an eligible expense, you may be able to claim a portion of the cost under the independent living tax credit for seniors [line 462]).

|

NOTE

|

Civic support services are services that enable you to fulfill your duties or civic obligations. Such services include:

-

help going to vote;

-

help completing forms; and

-

budget management.

|

NOTE

|

Laundry services include the care of your clothing and household linens (bedding, curtains, etc.) by a household service worker in your home.

|

NOTE

|

Supplying everyday necessities includes:

-

grocery delivery; and

-

prescription drug delivery.

|

NOTE

|

Ineligible services

The following services are not eligible:

-

services provided to you outside Québec;

-

services provided to you by your spouse or one of your dependants;

-

personal care services, meal preparation and delivery services, supervision and support services, civic support services and nursing services provided to you by a person who is claiming the tax credit for caregivers in respect of you (or by such a person's spouse);

-

personal care services and supervision and support services provided to you by a health professional exercising a profession recognized by Revenu Québec (while these services generally qualify for the tax credit for medical expenses, nursing services are eligible for the tax credit for home-support services for seniors);

-

minor maintenance work outside a dwelling (or the land on which it stands) that is not owned, leased or subleased by you or your spouse;

-

services governed by a professional order under the Professional Code and provided to you by a member of a professional order (for example, a professional chartered accountant, a notary or a podiatrist, though nursing services are eligible for the tax credit for home-support services for seniors);

-

services related to construction, renovation or repair work;

-

services that require a permit under the Building Act (for example, the services of an electrician, a plumber or a carpenter);

-

services included in the contribution payable for your housing and provided by the health and social services network (includes public CHSLDs, private CHSLDs that are under agreement [publicly funded], hospital centres, rehabilitation centres, intermediate resources and family-type resources).

For more information, see brochure IN-151-V, Overview of the Tax Credit for Home-Support Services for Seniors.

|

|

|