Line 463 - Senior assistance tax credit

Line 463 - Senior assistance tax credit

Line 463 - Senior assistance tax credit

You may be entitled to the refundable senior assistance tax credit if you qualify as an eligible individual and you meet at least one of the following conditions:

-

You were 70 or over on December 31, 2024.

-

Your spouse on December 31, 2024 (see the definition at line 12), qualifies as an eligible individual and was 70 or over on December 31, 2024.

|

NOTE If your spouse died in 2024, they had to meet the conditions on the date of their death rather than on December 31, 2024. |

You are considered an eligible individual if you met the following requirements on December 31, 2024:

-

You were resident in Québec.

-

You or your spouse on December 31, 2024, was:

-

a Canadian citizen;

-

a permanent resident or a protected person within the meaning of the Immigration and Refugee Protection Act; or

-

a temporary resident or the holder of a temporary resident permit, within the meaning of the Immigration and Refugee Protection Act, who had been living in Canada for the last 18 months.

-

However, you are not eligible if you were confined to a prison or similar institution on December 31, 2024, and you were confined for one or more periods totalling more than 183 days in 2024.

Note that the tax credit is reduced by 5.31% of the part of your family income that exceeds:

-

$44,015, if you had a spouse on December 31;

-

$27,065, if you did not have a spouse on December 31.

Your family income is the amount on line 275 of your return. If you had a spouse on December 31, 2024, your family income is the amount on line 275 of your return plus the amount on line 275 of your spouse's return.

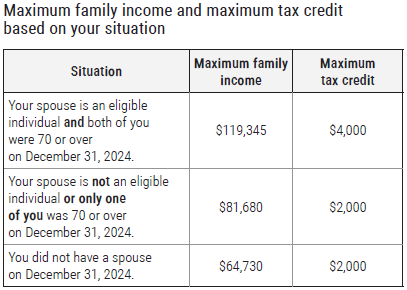

If your family income is equal to or greater than the maximum family income for your situation, you are not entitled to the tax credit. See the table below.

You do not have to claim the credit in your income tax return. We will calculate the credit for you, but if you prefer, you can calculate it yourself by completing form TP-1029.SA-V, Senior Assistance Tax Credit.

Splitting the credit

If your spouse on December 31, 2024, is also an eligible individual, you can split the credit with them by completing form TP-1029.SA-V. Only one of you has to enclose it with your return, but you both have to sign it.

|

|

|